As you start your online business and look for ways to streamline your company, you’ll find that ecommerce accounting and bookkeeping is essential.

From keeping track of your daily sales to having proper records in place for tax time, managing your books should never be put on the sidelines. Keeping your records straight and accurate ensures your business operates efficiently and legally, too.

Ecommerce accounting software can only help you so much.

Whether you’re selling on Amazon, or running your own Shopify site, you need to learn the basics of accounting.

Ecommerce Accounting And Business Basics

Accounting and bookkeeping are different concepts, but both equally as important for keeping track of your business. These tedious tasks might not be the most exciting things for small business owners to handle. This is why many ecommerce sellers outsource these tasks for others to do for them.

Whether you handle the accounting and bookkeeping duties yourself, or outsource these jobs to others, know these tasks are crucial to any business as they keep business records up-to-date and accurate.

What’s The Difference Between Accounting And Bookkeeping?

There’s a distinct difference between bookkeeping and accounting. However, these two concepts go hand-in-hand when running your ecommerce business. Bookkeeping is the recording of a business’ financial transactions. Accounting, on the other hand, is the interpretation of those business transactions.

With ecommerce bookkeeping, business owners or a hired bookkeeper keep track of sales, purchases, and payments. Bookkeeping is the way your company notes all costs and income. It’s also a way for you to keep an eye on business spending and profits and have records of these transactions.

Accounting is the process of taking bookkeeping records and organizing the data. This procedure applies whether you’re selling on WooCommerce, or on a marketplace like Amazon or Etsy.

Essentially its tracking down and organizing:

- Sales orders

- Invoices

- Sales receipts

- Bank statements

- Credit card statements

Accounting is the action of interpreting, analyzing, classifying, reporting, and summarizing the figures. It’s not enough to document spending and income. You must analyze the figures to see if you’re making a profit or losing money. With these answers, the ecommerce owner can figure out the best way to proceed with their business.

When you use accounting and bookkeeping together, you can keep track of your financial figures. You’ll also have a clear picture of your business financial state.

How to Keep the Most Accurate Financial Data

To know how your business is doing financially, you have to keep accurate records. When you do so, you can easily pull up figures and data when needed. Maintaining accurate financial reports keeps your business legal. It enables you to report actual and precise figures when tax time rolls around.

As you strive for the most accurate financial data and complete your accounting and bookkeeping duties, do the following:

- Create a financial roadmap

- Choose an accounting method

- Track purchases and inventory

- Keep track of payroll and payroll taxes

- Prepare a financial statement

- File taxes using your documents

- Get help when needed

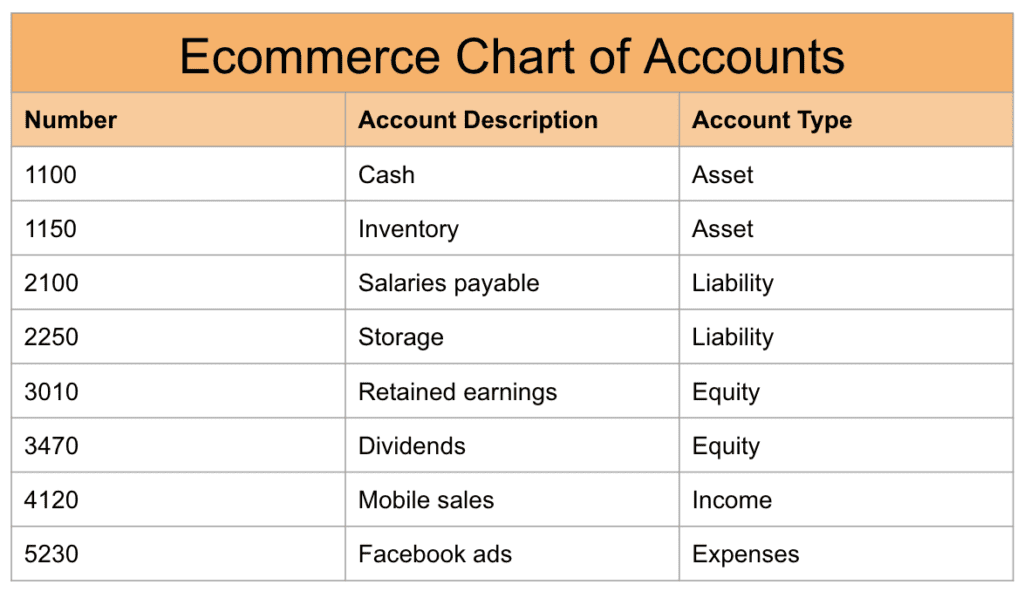

Creating A Financial Roadmap With A Chart of Accounts

When you first start handling the accounting and bookkeeping tasks for your ecommerce business, you’ll likely be overwhelmed. After all, there are a lot of figures you have to deal with in this job role. The best way to organize the accounting and bookkeeping items is to put them into a form you can understand. This is possible by creating a financial roadmap with a chart of accounts, or general ledger.

This chart of accounts categorizes figures into specific areas and organizes them in list form. This strategy makes it easy for you to identify each expense or profit and put it under a specific business category. Your chart of accounts may include:

- Item number

- Name of transaction

- Type of transaction

- Description

- Bank transactions balance

The way you organize your chart of accounts will depend on your business and sections you include. Also, your accounting and bookkeeping software might include the necessary categories for you.

No matter how you organize your chart of accounts, you want to make sure it’s a real-time updated chart. In other words, every time you sell a product and get paid, you want these numbers to immediately appear. Also, expenses paid should be added right away, too.

If you have a small or medium-sized business and want some software to help with this task, Quickbooks Online is one option to consider. Other cloud accounting options include:

- Freshbooks

- Xero

- And more

This software program will organize your chart of accounts and help you improve your cash flow. This program is ideal for tech-savvy individuals who need the organization and math skills of a software program to help with this task. Using a chart of accounts software program will also make human error mistakes less likely to occur.

Once you know how to keep your records organized, it’s time to move on to the next step, choosing an accounting method.

Choosing An Accounting Method

Before you get started entering numbers on the chart of accounts, you have to decide how you’re going to track income and expenses.

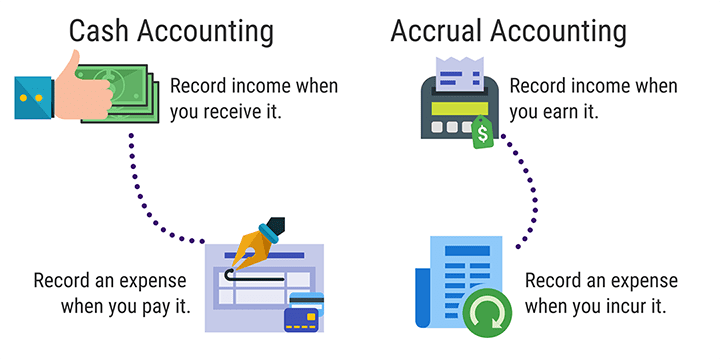

Two primary accounting methods include cash basis and accrual basis.

Cash Basis

A cash basis accounting system is when you record sales and expenses when money hits your business bank account or leaves it. It’s when you’ve received the cash in hand or sent it out for payment that you record this figure.

Accrual Basis

An accrual basis accounting system is in place when the figures are entered into your chart of accounts at the time the transaction has occurred. It’s not when the money is received in hand or sent out for payment.

The accounting method you choose is the one you’ll continue to use when you record financial transactions down the road.

Tracking Cash Flow: Purchases And Inventory

Accounting and bookkeeping duties involve tracking purchases and inventory every step of the way. You need to know how much inventory you sell and what’s left in stock. This way, you know your sales are accounted for and also know when it’s time to order more products.

As you record how much of your inventory has been sold, you must calculate the price each item sold for to keep proper count. For example, you need to note that you sold “x” number of sweatshirts at “y” price per sweatshirt.

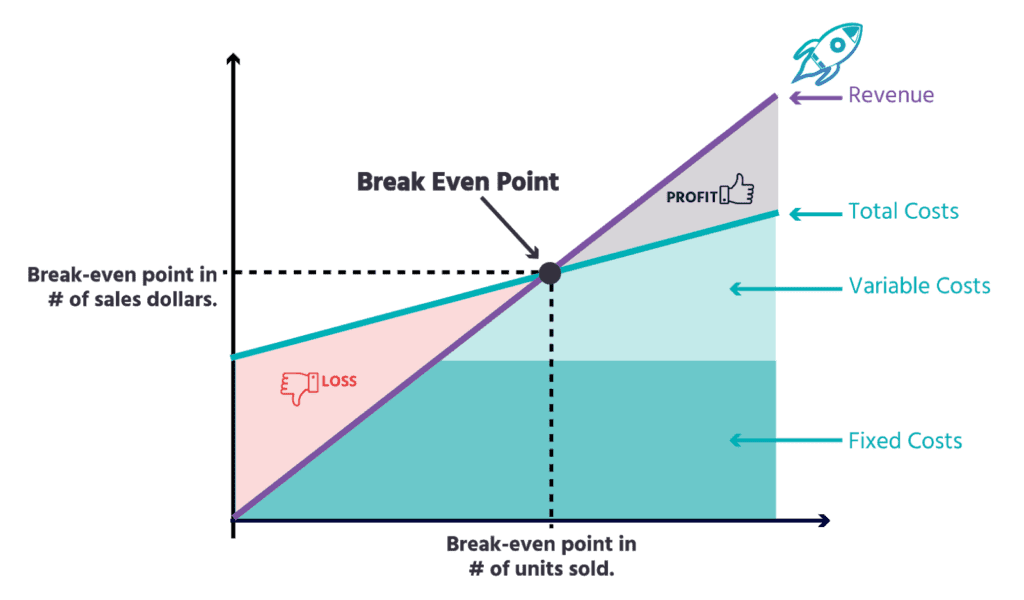

Another necessary step in purchase and inventory tracking is the break-even point analysis. The break-even analysis is a financial calculation that determines the number of products and services you have to sell to cover your costs. As an example, you might have to sell 200 units of your inventory to pay for the warehousing fee for the month.

Using a break even point calculator can help you determine if your sales will be enough to cover your costs and to what degree. With this calculator, you’ll be able to figure out how many products you must sell to break even. You’ll also know how many products you must sell to hit your target gross profit.

Understanding Cost Of Goods Sold

There are four factors to consider when tracking your purchases and inventory value. These include:

- Sales: Track your cash flow in the form of sales. You want to know how well your company is doing and if you’re making money or losing it. The sales data will help you do all of this.

- Discounts: Factor in any discounts that you offer on the products you sell. This price difference will affect the bottom line.

- Returns: Keep track of returns, both for monetary reasons and inventory reasons.

- Assets: Assets can include cash, inventory, and anything else in your business with monetary worth.

Keeping a close eye on these items and adequately tracking them will keep your records accurate. It will also provide you with a proper representation of your business. You need to know what products are coming and going in your ecommerce business. You also need to know how much worth is attached to it all.

Accounts receivable is an essential concept under this section. It’s the process of invoice sending and tracking whether or not invoices are paid. Accounts receivable, such as credit card payments, is revenue at the time of the sale.

Accounts receivable duties are tasks that were done by hand in the past. This was an extremely timely task. Today, many ecommerce accounting software programs include helpful accounts receivable functions.

Platform Integrations

With the right platform integrations, you can easily track your sales, returns, and other figures. All your software should integrate so your company operates like a well-oiled machine.

When you choose an accounting ecommerce software, consider how it works with your online ecommerce and fulfillment platforms. You need all your ecommerce platforms to function together to lead to the most effective results.

Payroll and Payroll Taxes

As an ecommerce entrepreneur, you’re going to come face-to-face with payroll duties and payroll taxes. It’s inevitable if you have employees working for you. Fortunately, technology makes this challenging task a bit easier.

If you have employees, you need to keep track of payroll processing and payroll taxes. However, if you want to take a hands-off approach, you can hire an accountant or bookkeeper to do it for you.

If you want to do it yourself, there are plenty of software programs to guide you along the way. Just keep the following factors in mind:

- Keep track of your remote employees through accounting and global payroll software.

- Make sure your chosen program deals with payroll and payroll taxes.

- Check to be sure this payroll software integrates with your other platforms.

When you have the right system in place for tracking payroll and payroll taxes, you can keep documents up-to-date. This ensures your hardworking team members get paid on time and have their taxes taken out. You’ll also have useful records to refer to when tax time rolls around and you prepare your annual tax documents.

Preparing Financial Statements

Financial statements are the next piece of the accounting and bookkeeping puzzle. These requirements consist of three main areas, including generally accepted accounting principles (GAAP)/accounting standards, income statements, and balance sheets.

All three tools will help you organize your income and expenses. These items identify what’s coming into your company and what’s going out, plus it puts everything in an orderly format.

Ecommerce accounting and bookkeeping software can help with these accounting duties and make your life easier and more organized overall.

GAAP/Accounting Standards

GAAP is a common set of accounting principles. These standards and procedures are instituted by the Financial Accounting Standards Board (FASB).

With GAAP, ecommerce business owners have to match each expense with the associated revenue. Also, the inventory value has to be tracked from the production point through the point of sale.

A sound inventory management system will help keep track of inventory from production through the sale.

Income Statement

The income statement, also called a profit and loss statement, indicates how your business is doing financially over a certain period, such as a few months or a year. This document tracks sales and expenses and shows you the difference between the two items, your net income.

Income statements come in handy to pick up on sales trends, predict future performance, and monitor your key performance indicators (KPIs). They will include your cost of goods sold, or the cost of sales, so you can see what income you have due to sales.

Pro Tip: As the CEO/CFO, make sure you understand your customer acquisition costs. You can’t leave that up to a bookkeeping service.

The margin between your cost of goods sold and net profit should be stable as well as predictable. And always remember to record your cost of goods sold when you sell each piece of inventory. Doing so ensures that your income statement is right on point.

Balance Sheet

The balance sheet is what keeps track of your business’ wealth over the lifetime of the company. This accounting document is the bigger picture when compared with the income statement.

The balance sheet highlights your company’s long-term financial health so you can see how well your company is currently doing and how this compares with past years in business.

This document covers assets, liabilities, and equity. Assets are items of value that you possess, liabilities are your debts, and equity is the difference between these two items.

Assets come in various forms, including:

- Cash

- Accounts receivable

- Stock

- Buildings

- Equipment

- Paid business insurance

Liabilities also include quite a few items, such as:

- Accounts payable

- Taxes payable

- Salaries payable

- Loans payable

- Loan interest

- Expenses payable

- Equipment leasing agreements

You should review all these items to determine the overall financial health of your company.

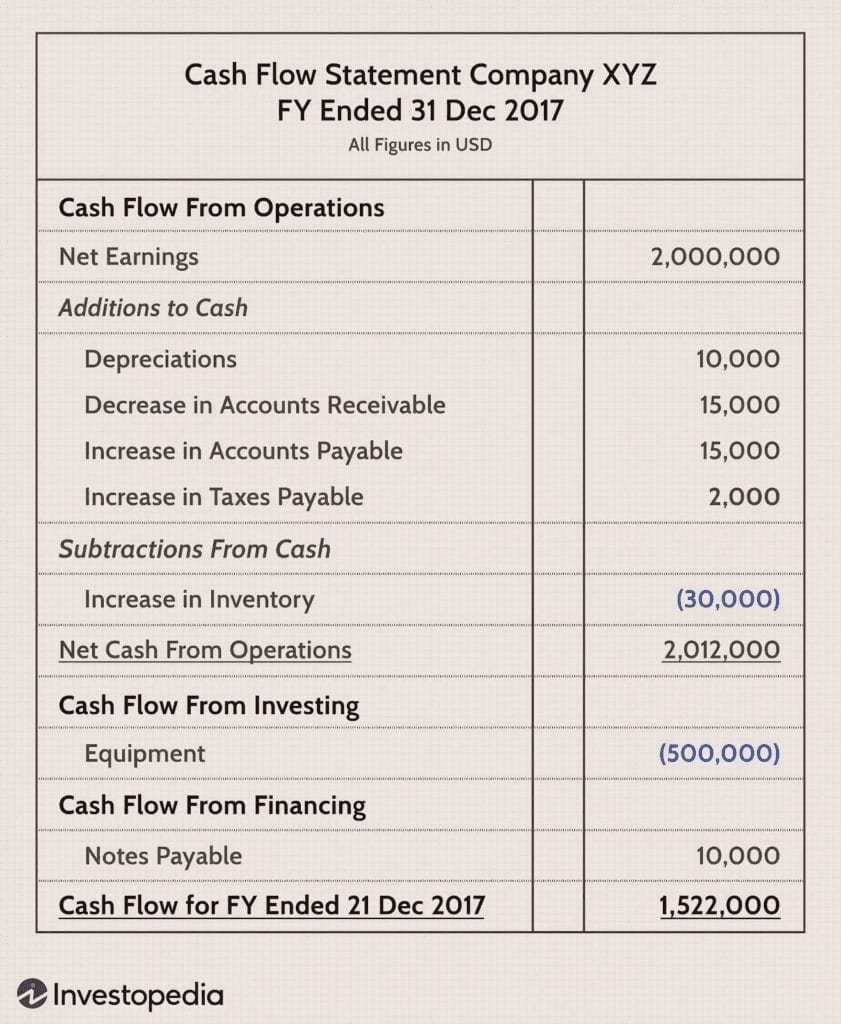

Cash Flow Statement

The statement of cash flows is especially important if you engage with any financing activities, such as investments or loans.

This extremely helpful document keeps track of cash and cash equivalents coming into your online store and going out, too.

Your cash flow statement helps you understand how much free cash flow your company has at its disposal.

Filing Taxes

Paying taxes is something you’re going to have to do on a continual basis as an ecommerce business. You can handle this task yourself or hire someone to do the taxes for you.

Let’s face it. Paying taxes is a tedious task, but you have to do it. And when tax season rolls around, and you file your tax returns, make sure they’re correct and complete.

Depending on your location, you’ll likely be paying federal, state, and other taxes. Plus, you’ll have to pay the sales tax you collect from the customers to the right governmental entities. Usually, ecommerce platforms include a sales tax portion and collect this tax from customers when they buy your products.

With that said, you’ll likely have your bookkeeper handle the sales tax portion on the other end when it comes time to pay it to the government for sales tax compliance. Your bookkeeper will also let you know if there’s a sales tax nexus and who receives the tax collected from the sale. You have to follow sales tax laws, so be sure you know who you have to pay and how much you owe. This is also true when selling on Amazon.

To make sure you’re paying all your required taxes to the right governmental entities, it’s best to consult with a tax professional or use tax filing software. Either of these methods will help you with this headache of a task and make sure you do it the right way.

Getting Help

Before you go online and start searching for ecommerce companies to help you with every step of the accounting and bookkeeping list, try to understand what each concept entails.

Hopefully, this 101 guide activated your accounting brain. If you’re an Amazon seller, check out this guide.

After reviewing the topics above, you might find that you can easily accomplish one or more of these goals on your own. When you do so, you’ll be in control of the different areas of your business and could save some money in the long run. You can even use financial model templates to help you out.

With that said, it’s essential to know when you can’t do it on your own. If something listed above is way out of your comfort zone or you don’t have the time to do these accounting tasks well, ask for help. You should focus on the tasks you do best and outsource the jobs you really can’t do or don’t want to do.

When you hire an accounting firm or bookkeeper, you can focus your efforts on other aspects of your business. You can spend time marketing your ecommerce website to draw in new customers and handling other important business decisions while the financial professionals handle these tasks for you.

If you decide you’re ready to hire an accounting company to help you out, consider your options. You can hire actual individuals to do the job for you or purchase software to assist you in your quest to complete these jobs on your own.

When the time comes to get help, here’s some information to know:

Advisors and Accounting Solutions

Accounting and bookkeeping assistance comes in many forms, including software, CPA professionals, and bookkeepers.

Ecom CPA is one service provider you might want to use. This company specializes in accounting and bookkeeping services for ecommerce businesses such as accrual accounting, monthly statement preparation, and profitability analysis.

You might also want to use CFO services from Lyfe Accounting to help you with your business needs.

And, since having a good amount of choices is ideal, be sure to check out Webgility software accounting services, too.

Need some more help and want accounting software to guide you along the way? Check out the accounting software post on EcommerceCEO.com and find the software program that suits your needs just right!

Feel Confident About Your Company’s Accounting

Now that you know the bookkeeping and accounting basics for your ecommerce store, you can feel confident knowing exactly where to begin. After you review this guide of accounting and bookkeeping procedures and best practices, you can decide if you’re able to handle the duties on your own or need some outside help.

If you know you’ll need a professional to help you with these tasks, outsource these jobs to third party companies. After all, these individuals are well-versed in these areas and trained to complete the ecommerce accounting and bookkeeping tasks for you.

Whichever route you decide to take, make sure to review your financial documents continually. This task helps to ensure the information is correct and you truly understand the financial wellbeing of your ecommerce company.