Determining economic nexus in each state is complicated and overwhelming for many sellers, but our sales tax guide can help demystify the topic, and offer step by step guidelines for sellers to check their requirements.

Please note, nothing in this article should be construed as legal or tax advice.The contents of this website are intended to convey general information only and not to provide legal advice or opinions. For specific advice contact Ecom CPA.

So you started an ecommerce business – and it’s growing! As your sales grow, it’s important to be sure that you’re legally compliant with the states you’re operating and selling in. One area you need to pay attention to is internet sales tax.

If you’re a blogger, taxes is straight forward. For ecommerce sellers, sales tax can be intimidating, since every state and territory sets their own rules. But sales tax, especially on Amazon, doesn’t have to be that scary. Here’s our rundown of what you need to know as an ecommerce seller, and what options you have for ensuring that your sales tax is handled.

Sales Tax: Then and Now

Modern retail sales tax is generally considered to date back to 1930, and is managed at a state level. Sales tax requires merchants pay sales tax of some kind in states where they have a presence, also known as “nexus”. The sales tax is collected from the consumer, by the merchant, who then sends the collected taxes to the state the tax was collected for.

Historically, states have recognized nexus in these situations:

- Home state nexus: your company is physically based in California, giving you nexus there.

- Employee nexus: your company is based in California, but you hire employees in Nevada. You now have sales tax nexus in both states, and must collect sales tax from buyers in both states.

- Inventory nexus: you store your inventory in a warehouse in a state that has inventory nexus, creating sales tax nexus.

With the increase in ecommerce, a new type of nexus is being recognized: that of remote sellers, referred to as economic nexus.

- Economic nexus: you’re considered to have nexus (or “economic presence”) in a state because you had a certain dollar amount of sales in that state, or have a certain number of sales transactions in that state.

Creation of Economic Nexus

This came about in June 2018, when the United States Supreme Court ruled in South Dakota v Wayfair that states can also require online sellers to collect sales tax based on the volume or value of transactions into a state, which create economic nexus.

One of the reasons behind the move to tax economic nexus is important in this case – South Dakota does not impose income tax on its residents, which means it relies heavily on sales tax. As physical businesses lose more business to remote sellers, failure to tax these retailers results in a loss of tax revenue to the state.

In Wayfair vs.South Dakota, the state estimated that $50 million had been lost in sales tax revenue.

Recent Developments

Following South Dakota vs. Wayfair, the majority of U.S. states have now enacted economic nexus laws for remote sellers. As of August 2020, all but six states (plus Puerto Rico) have economic nexus laws. However, these laws are always in flux.

For example, in 2019, several states eliminated thresholds based on transaction volume (i.e. “200 transactions”), basing their thresholds entirely on sales volume (for example, $100,000 in sales). Other states raised or lowered their thresholds.

As economic nexus and the sales tax requirements become more complicated, other groups are beginning to weigh in on the process. Recently the Multistate Tax Commission, an intergovernmental state tax agency created in 1967, made recommendations to simplify both nexus thresholds, and the sales tax return process.

Economic Impact of ecommerce

So how much does ecommerce disrupt brick and mortar business? In 2019, the global business-to-consumer ecommerce market was valued at over $3 trillion. It’s projected to grow at a rate of 7.9% through 202,7 according to Grandview Research.

In 2020, ecommerce accelerated even faster than expected as a result of the COVID-19 pandemic and quarantine measures to contain it. As consumers attempted to limit social contact and stay at home, online shopping took off like never before.

How Sales Tax Works for Remote Sellers

Earlier, we touched on how economic nexus is determined: you’re considered to have nexus in a state because you had a certain dollar amount of sales in that state, or have a certain number of sales transactions in that state.

However, there are a number of other reasons remote sellers may find they have nexus in a state. We’ll go through the rules of each state later, but first let’s review the most common types of nexus.

If you have any of the following arrangements as a remote seller, you may have nexus in multiple states, even if you have not hit the economic nexus threshold in that state. Keep in mind that the exact definitions and fine print differ with each state. Check individual state regulations if these rules apply to you.

Physical Nexus

Physical nexus refers to a physical palace of business, usually defined as an office, retail location, show room, etc. Remote sellers must still remember that they have “home state nexus” wherever their business is registered, and must pay sales tax there (if the state collects sales tax). To a remote seller’s home state, the requirements are the same as with any brick and mortar business that is operating in the state.

Employee Nexus

Employee nexus generally applies to businesses who have employees in the state. This can also sometimes include salespeople, representatives, contractors, or any kind of agent.

If you have employees or representatives in another state, check the specific laws of the state they are operating in to find out whether or not they recognize employee nexus. If they do, you may be required to collect and remit sales tax there.

Inventory Nexus

In the same way that Amazon stores inventory all over the country, many ecommerce sellers choose to house their inventory in strategic states to accommodate faster shipping. This may be done in a number of different ways, including:

- keeping a dedicated warehouse;

- Working with a third party who fulfills your orders (dropshipping); or

- using a 3PL company to store and deliver your products.

Regardless of the arrenagment, inventory in another state may constitute nexus, depending on the state.

Amazon FBA sellers are particularly likely to have this consideration – to determine where your inventory is stored as an FBA seller, pull an Inventory Detail Report from Amazon Seller Central.

Click-through Nexus / Affiliate Nexus

Click through or affiliate nexus is an interesting type of nexus, and can be very complicated. Affiliate websites often promote or advertise products for another business, redirecting consumers to that site in exchange for a commission or other compensation.

Some states now consider a remote seller with an in-state affiliate to have clickthrough nexus in their state, even if the seller has not reached economic or any other type of nexus. New York, California, and Illinois are a few of the states who have recognized affiliate nexus.

Production Nexus

In some states, a product being manufactured, created, or assembled in that state is enough to constitute nexus. In Hawaii, the presence of a product’s developer may constitute nexus.

Business Presence Nexus

The registration of a business entity, even sometimes a mailing address in the state, may be enough to constitute nexus, even if the business has no physical presence and makes no sales in the state.

Solicitation Nexus

Advertising or soliciting business in a state can create nexus in a number of states. This may include print advertising, sales calls, salespersons, or even systematic solicitation by electronic means (i.e. an email list).

Service Nexus

A business who performs services for clients may have nexus on that basis. This may include installation, repair, or services through a third-party contractor.

Property Ownership Nexus

An entity that owns or leases property creates nexus for itself in many states. This can be either real property (real estate) or personal property, such as vehicles, fixtures, or other equipment.

Delivery Nexus

A business who delivers products into another state may have nexus there, depending on the state’s specific rules. This rule is often specifically limited to “delivery into the state on vehicles owned by the taxpayer”.

Origin versus destination sales tax

In calculating your sales tax you’ll deal with the important difference of “destination states” versus “origin states”. Although in the past most states have tended to be destination-based, the rise of ecommerce has seen a shift to origin-based sales tax, which allows the state the product is shipped from to retain more of the tax revenue collected by businesses operating in that state.

Destination states

Destination states determine the amount of sales tax required to be collected based on the destination of the goods (i.e. where the buyer is receiving them).

Therefore if your business is operating in a destination state, and you sell a product to a buyer in a state where you don’t have economic nexus, you don’t have to collect sales tax on it. If you’ve passed the threshold and you DO have economic nexus, you’d collect the amount of sales tax required by the buyer’s location.

As you can probably guess, this is the more complicated of the two, because sales tax can vary by state, city and county.

Destination States with No Sales Tax

There are a few states that do not charge sales tax, such as ECOM CPA’s home state of Oregon, as well as New Hampshire, Montana, Alaska,and Delaware (easily remembered by the acronym “NOMAD”. However, be aware that in some cases (Alaska for example) even if there is no state sales tax, local jurisdictions can choose to charge sales tax, meaning that it is still a “destination” state, where the local sales tax applies.

For remote sellers (i.e. physically based in one state and selling to another), sales tax is usually destination-based.

Origin States

In origin states, the amount of sales tax charged is based on the rates at the origination point of the product, or where the product is shipped from.

Currently, the 11 origin-based states are:

- Arizona

- California*

- Illinois

- Mississippi

- Missouri

- New Mexico

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

*California is mixed

Hybrid states

California is, of course, a little more complicated – it is a mixed case. City, county and state sales taxes are origin-based, while district sales taxes (supplementary local taxes) are destination-based. For a California-based seller who makes a sale to another location in California, any city, county or state taxes will be based on the seller’s location (origin-based), while any district sales taxes will be based on the customer’s location (destination-based).

How to Deal with Sales Tax as a Remote Seller

If you are doing business as an ecommerce seller, your first step is to determine whether you have nexus in any states. If your sales are still small, you may be able to do this yourself.

The basic steps are:

- Determine where you have sales tax nexus;

- Register for the appropriate sales tax permit.

- Choose and implement a service or software to automate tax collection and calculation.

- Track due dates and file sales tax returns according to each state’s schedule.

Determining Nexus

To determine where you have nexus, start with some basic questions:

- Is the state you’re shipping from an origin state, or a destination state? If an origin state, find out what the threshold is for sales tax collection.

- Do you have inventory or employees in any other states? If so, check their nexus laws, and find out if this qualifies.

- Organize your sales records by state, and total your sales volume and number of transactions for each state.

- Compare your state totals with the current nexus laws for each state. Use the links in this article to move more quickly.

- If you are at or above either the volume or sales threshold, you’ve got nexus there.

Nexus in Another State

Let’s say you’ve been collecting sales tax in your home state, but after performing the above analysis, you see you should be collecting in two additional states. Here’s what to do next.

Get Sales Permit/Registration

In some states it’s referred to as a “sales tax permit”, in others it’s “sales tax registration”. Same thing. The point is, you need to have the permit or registration prior to collecting the sales tax (it’s illegal to collect sales tax without authorization). This can often be done online.

Each state is a little bit different. Some charge a small fee to register and others none at all. Be sure to review the rules on the state Department of Revenue so that you’re aware of due dates and required renewals.

When the Threshold is Crossed

For example: the threshold in a given state is $200,000 in volume in the current year. Two months ago you sold $198,000 there. No nexus. Last month you sold $201,000. Nexus.

To remain compliant, register for sales tax collection now and begin collecting taxes going forward. You do not need to pay sales tax for last month ($201,000) because you had not previously met the requirement to begin collecting sales tax, and therefore you weren’t collecting any.

Product Exemptions

Depending on the type of product you’re selling there may be even more to know about sales tax. For example, food products are often taxed differently than other types of products. Non-prescription drugs and clothing are also frequently tax-free or taxed at a lower rate. Digital products may have different sales tax rates as well.

Some ecommerce platforms have sales tax overrides that you can use to set up special rules for these types of products, but it’s wise to do your research and be sure that your product qualifies first.

Collect Sales Tax

Once your nexus is determined and your permits are filed, you’ll need to configure your sales tax collection. Luckily, most sales platforms offer some level of automation with this. Here, we’ll cover the basics of setting up sales tax collection in two of the biggest platforms: Amazon and Shopify.

Amazon

Amazon is a marketplace facilitator in a number of states. This means the obligation to calculate, collect, and remit sales tax for sellers falls on Amazon – but not for every state.

Amazon sellers are still responsible for determining and registering in states where they have nexus. Registration will give sellers a state sales tax registration number, which is required to collect sales tax through Amazon.

From there, Amazon can take much of the work off sellers’s hands. With a little set-up, sales tax collection can be almost entirely automated. The tax rate will be updated by Amazon if rates change. Amazon also tracks destination and origin states, so you don’t have to.

To automate sales tax collection in Amazon, visit your tax settings Seller Central. Here you can set which states need sales tax collected, and at which levels (state, county or local). You can also add a product tax code in case some of your products are exempt, or are subject to a reduced tax rate.

Once you’ve set up your sales tax collection and need to file your sales tax returns, you can download a report from Seller Central with all of the data on collected sales tax. Then, you’ll either need to add and calculate the figures yourself, or work with a sales tax service to do it for you.

Shopify

Shopify can also be configured for tax collection, down to the local tax rate. Like Amazon, the platform will not tell you where you should be registering and paying sales tax – you’ll need to do that, or hire a service to do it.

Once you have identified and registered for the appropriate tax jurisdictions, you can configure Shopify to collect for you.

To set this up, visit Taxes > Settings > Set up (under “Tax regions”). You’ll need to add your tax registration ID from any states where you want to collect.

Shopify will also allow you to set a tax override, if the default tax rates do not apply to you or your products. You also have the option to collect tax on shipping costs in a few states.

When it’s time to pull the information for sales tax returns, you can download a Sales Finance Report (choose the Full Report). This will include all the necessary data about sales tax collected, for you or your sales tax service to calculate and file returns.

File your Return and Remit Sales Tax

After collecting sales tax, you’ll need to file a return with the states you’ve collected for, and turn over the taxes to them. This is also referred to as “remitting” sales tax. One important thing to note is that if you are registered to collect tax in a state, but make no sales for a given period, you should still file a $0 return, to avoid being penalized for not filing.

But when it comes to filing schedules, things get complicated – each state makes their own rules, so they all have a different schedule for when sales tax returns must be filed. For many states, the requirement to file monthly, quarterly, or annually, depends on your average monthly tax liability.

The bottom line is, if you are handling your own sales tax and you’re starting to have nexus in multiple states, set up a system of due dates and reminders for each.

Outsourcing Your Sales Tax Returns

Of course, in this day and age, you can always pay someone else to do it. With sales tax, you have two basic options: an automated service, or a live person.

What can be automated, and what can’t be.

Automated Platforms

When it comes to automated platforms, the two most reliable and well-known are TaxJar and Avalara.

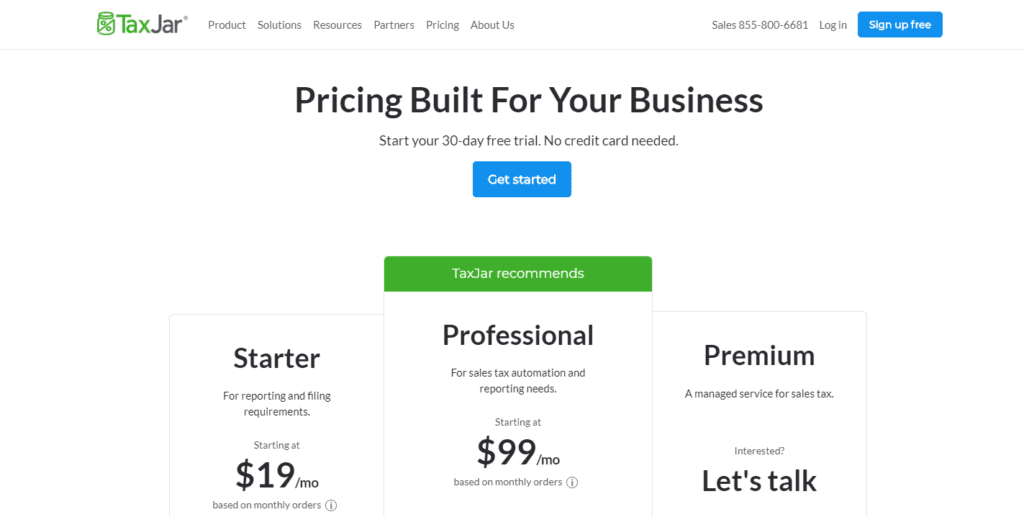

TaxJar

Taxjar is an automated service that will submit your sales tax returns to the states you are registered in. This also takes due date tracking off of your plate. TaxJar also offers easy integrations with all of the major platforms and payment gateways: Amazon, Shopify, eBay, BigCommerce, Etsy, Adobe Commerce, WooCommerce, Square, and Paypal.

Taxjar now offers an Economic Nexus Insights Dashboard, which will tell you where you currently have nexus, and where you’re approaching it. However, TaxJar won’t file your paperwork to obtain sales tax permits. TaxJar is fairly affordable, with tiered pricing that offers a limited number of returns per year.

Avalara Avatax

Avalara’s Avatax is a more robust system, and part of a system with several other products in addition to Avatax. It’s also pricier.

Avatax will track your sales to show you where you need to register, automatically applying product exemptions that apply in each state. It will also file your returns and remit the sales tax for you, and they do offer assistance registering in a new state.

Avalara also offers products with support for international sellers, who collect customs and import taxes (for example VAT tax).

Live Service

While the DIY method may be fine for smaller sellers, if you’re doing a large volume of business, it’s probably time to outsource to a professional. Not only is sales tax analysis detailed and time-consuming, but the exemption rules differ from state to state, and a miscalculation could result in penalties and late fees.

If you prefer a live person over automation, there are a number of companies that offer sales tax services. ECOM CPA offers a comprehensive 50-state nexus study to determine where nexus has been reached, as well as registration, filing services, and assistance setting up an automated solution.

Failure to Pay Sales Tax

If a merchant fails to pay sales tax when they should have, they’re likely to eventually receive an assessment letter, which requires that the merchant submit past-due sales tax returns and pay them. Penalties and interest for late filing often amount to 30% of the overdue tax.

If the state believes your intent was to defraud them (i.e. you knew the tax was owed and chose not to pay it), criminal penalties can apply as well.

Sales Tax Discounts

It can pay to do a little research on available discounts. Currently, around 26 states will give you a discount on the sales tax you’ve collected, if you pay early or on time.

For example, Georgia allows sellers to keep 3% of the first $3000 due, and .5% of anything above that – just for paying on time.

For further reading, check out these resources:

- Shopify Tax Help

- Amazon Tax Calculation Services

- Avalara Sales Tax Calculator and Lookup Tool

- Amazon Tax Guide

Sales Tax Directory: By State

Alabama

- Destination state

- State, county,and city taxes may apply.

- $250,000 threshold

- No sales tax on shipping

The following types of presence constitute nexus in Alabama:

- Physical nexus

- Inventory nexus

- Employee or representative nexus

- Economic nexus

Alabama’s Department of Revenue lays out the state sales tax regulations here. Reduced rates apply to certain farm machinery, and autos and trucks.

The schedule for remitting sales tax is as follows:

- If sales tax liability is over $200 per month, returns are due monthly by the 20th.

- If sales tax liability is under $200 per month, an election may be made to file quarterly.

- If sales tax liability is under $10, returns may be filed on a calendar year basis.

Alaska

- Destination state – but, with no state sales tax

- City and borough taxes may apply

The following types of presence constitute nexus in Alaska:

- Retail presence

- Inventory nexus

- Representative nexus

Since Alaska is a “home rule” state (meaning it defers much of it’s taxation authority to local jurisdictions) exemptions and reduced rates vary by city and county, or “borough”. Of the 321 communities in Alaska, 107 levy some kind of tax. These range from 1%-7%.

Unfortunately for remote sellers, you’re on your own when it comes to contacting each and every locality to understand their rules and collect their forms for sales tax. More information and helpful resources can be found on the State Assessor’s website, including the yearly Alaska Tax Report, an intense but still helpful publication which maps the different boroughs and their tax policies.

Arizona

- Origin state

- Shipping is not taxed

- Graduating threshold of:

- $200,000 yearly gross revenue in 2019

- $150,000 yearly gross revenue in 2020

- $100,000 yearly gross revenue in 2021

The following types of presence constitute nexus in Arizona:

- Physical nexus

- Inventory nexus

- Personal property nexus

- Delivery nexus

- Employee or contractor nexus

Arizona’s remote seller regulations took effect in October of 2019. The thresholds for state sales tax (or “transaction privilege tax”) apply to remote sellers who meet the thresholds in either the current or previous year.

However, if you are selling through a marketplace facilitator who collects and remits sales tax in the state, you are not required to register for state sales tax.

If you’re still not sure if your business has nexus in Arizona, the state offers a handy Nexus Questionnaire to help you decide.

Arkansas

- Destination state

- Threshold of either:

- $100,000 in yearly sales, or

- 200 yearly transactions

- Shipping may be taxed

A business has nexus in Arkansas if they maintain any of the following:

- Place of business (including an office)

- Warehouse space

- Real or personal property

Arkansas’s remote seller regulations kicked in July of 2019, levying a sales tax on remote sellers who cross the volume or sales threshold in either the current or previous year. Arkansas does have some exemptions from sales tax based on the product type. You can review those exemptions here.

California

- Origin/destination hybrid state

- Threshold of $500,000 in sales

- Services are not taxable, but products are

- Shipping is

- not taxable, if it is charged to the customer as a separate line item and made by common carrier;

- taxable, if combined with the product cost or with “handling”

California considers a retailer to have nexus if any of the following apply:

- Physical nexus

- Inventory nexus

- Representative, agent, or independent contractor nexus

- Personal property nexus

- Presence at a tradeshow (more than 15 days and over $100,000 in resulting net income)

California’s hybrid sales tax requires some explanation: State, county, and city taxes are origin-based, therefore collected based on the seller’s location, while supplementary district taxes are destination-based, dependent on the buyer’s location.

California’s Tax Guide for Out-of State Retailers is helpful in explaining the fine print on the reasons a retailer is considered to be “engaged in business” in the state. Sales tax exemptions include sales to other retailers, as well as some food.

To avoid paying sales tax as a retailer who sells to other merchants, sellers should ensure that they have a valid resale certificate.

Colorado

- Destination state

- Threshold of $100,000 in yearly sales

- Shipping is

- not taxable, if it is charged to the customer as a separate line item

- taxable, if combined with the product cost or with “handling”

The following types of presence constitute nexus in Colorado:

- Physical nexus

- Personal property (sold or leased)

- Solicitation nexus

Many remote sellers doing business in Colorado may fall under the “Small Business Exception”. This rule states that retailers who don’t maintain a physical presence in the state (as defined by the nexus list above) are exempt from sales tax if they do not reach the $100,000 threshold.

Once a retailer has reached nexus, they have 90 days to register in Colorado. There are some sales tax exemptions which can be found on the Department of Revenue’s website.

Connecticut

- Destination state

- Threshold is $100,000 in gross sales, and at least 200 transactions.

- Shipping is taxable as long as the product is taxable

Nexus is constituted by:

- Physical nexus

- Employee, representative, or contractor nexus (more than 2 days per year)

- Inventory nexus

- Property ownership nexus

- Delivery nexus

When it comes to sales and use tax, Connecticut is an easier state for remote sellers to work with, since there are no county or municipal taxes. Only the state sales tax needs to be accounted for.

Connecticut does also recognize marketplace facilitators, who must register with the Department of Revenue and Sales for a permit.

Delaware

- No state sales tax

As one of the “NOMAD” states, Delaware has no state sales tax. Currently, the state’s position is that “…the mere use of the Internet as a vehicle for selling tangible property or intangible personal property will not create nexus in the market state.”

However, there is a business license fee and gross receipts tax on “various services rendered within the state”. For more information, check out the Department of Revenue and their FAQ regarding internet sales.

Florida

Currently, only Florida and Missouri have not adopted sales tax rules pertaining specifically to remote sellers.

However, there is a bill in the works which would change that. A fiscal analysis estimates that the state lost at least $8.5 million in tax revenue as a result of not enacting a remote sales tax rule. If you are doing more than $100,000 of sales or 200 transactions in Florida, keep an eye on this one.

Georgia

- Destination state

- Graduating threshold of:

- $250,000 in gross revenue, or 200 transactions in 2019

- $100,000 in gross revenue, or 200 transactions in 2020

- Shipping is taxable

Nexus in Georgia is created by:

- Physical nexus (including presence at a trade show, above certain thresholds)

- Inventory nexus

- Employees or representative nexus

- Property ownership nexus

- Delivery nexus

These regulations went into effect in 2019. Starting in 2020, the state also began requiring marketplace facilitators generating more than $100,000 to collect sales tax for third-party sellers.

Interestingly, Georgia currently considers remote dropshippers to be “resellers”, and exempts these transactions from retail tax (although the appropriate paperwork must be in line). Products exempt from sales tax include some educational materials, food, and prescriptions.

Georgia’s thresholds apply to the current or previous calendar year, and will require the seller to collect both the state and local tax rate.

Hawaii

- No explicit “sales tax”, but an excise tax

- Threshold of $100,000 in gross revenue, or 200 transactions

- Shipping is taxable

Nexus is created in Hawaii by having:

- Physical nexus

- Inventory nexus

- Affiliate nexus

- Solicitation nexus

- Economic nexus

Technically, there’s no “sales tax” in Hawaii – but the state mandates a 4% general excise tax (GET) on businesses in the state. Local taxes may also apply. That now includes remote sellers who meet the economic nexus thresholds. These thresholds apply to the current and prior year.

Hawaii began requiring marketplace facilitators to collect and remit GET in 2020.

Idaho

- Destination state

- Threshold of $100,000 in sales

- Shipping is not taxable when listed as a separate line item

Idaho considers a seller to have nexus if they have any of the following in Idaho:

- Physical nexus

- Inventory nexus

- Employee or representatives nexus

Idaho’s economic nexus law went into effect in June 2019, and applies to both remote sellers and marketplace facilitators. The threshold applies to current or prior year sales. The good news is that with no physical location in Idaho, remote sellers are only liable for the 6% state tax – no local taxes. The frequency of filing depends on the average monthly tax liability, and ranges from annually to monthly.

Additionally, services are not taxed in Idaho – only physical products. Product exemptions include currency, computer software, resale goods, and more.

Illinois

- Destination state for remote sellers; origin state for in-state sellers

- Threshold of $100,000 in gross revenue, or 200 transactions in 12 months

- Shipping is taxable unless it is a separate line item, or pick-up option is offered.

Nexus is constituted in Illinois when a seller has:

- Physical nexus

- Inventory nexus

- Representative nexus

- “Click-through” or affiliate nexus

Marketplace facilitators are recognized in Illinois as of 2020, and are required to collect and remit sales tax for sellers. However, there is some fine print regarding the Illinois Retailers’ Occupation Tax, which requires the seller to take responsibility for sales tax rather than the marketplace facilitator.

Illinois’ sales tax rules exclude resale items from sales tax. Other exemptions can be found on the State of Illinois website.

Indiana

- Destination state

- Threshold of $100,000 in gross revenue, or 200 transactions

- Shipping is taxable

Nexus is created when a business maintains in Indiana:

- Property ownership nexus

- Inventory nexus

- Employees or representatives nexus

- Service nexus (including through a third party)

Indiana doesn’t have local taxes, so remote sellers are only liable for the state’s 7% tax rate. The threshold requirements apply to either the current or previous year.Depending on the volume of sales tax liability, the filing frequency is either monthly or annually.

Although products in Indiana are taxable, services are often not – unless the service relates to fabricating, altering, or preparing a product. Unprepared grocery food and health care products are some of the items exempt from sales tax.

Iowa

- Destination state

- Threshold of $100,000 in yearly gross revenue, or 200 transactions

- Shipping is only taxable when included in product price

Iowa considers a seller to have nexus if they have:

- Delivery nexus (on a regular basis)

- Physical nexus

- Inventory nexus

- Contractor or service nexus

If you’re still not sure, you can take a questionnaire on the Iowa Department of Revenue site to help determine if you have nexus.

Services are sometimes taxable in Iowa. A list of products exempt from taxation can also be found on the state website, and includes software, containers, and food.

The Iowa thresholds for remote sellers apply to the previous or current calendar year. Remote sellers only need to collect and remit the state sales tax of 6%, no local taxes. Filing frequency depends on the amount of tax estimated to be due.

Kansas

- Destination state

- Threshold of $1

- Shipping is taxable

Nexus created in Kansas by:

- Physical nexus (including trade shows, festivals, and other retail events)

- Inventory nexus

- Employee or contractor nexus

No, that’s not a typo – Kansas does not offer any kind of exception for remote sellers, so any remote sellers who make any sales in Kansas will meet the threshold. Starting in 2019, all remote sellers delivering to Kansas must register with the Department of Revenue, and collect and remit sales tax. There is some speculation that this may change in the future, so if you have sales in Kansas, keep an eye on this one.

Information on exempt products and exemption certificates can be found on the Kansas Department of Revenue Website.

Kentucky

- Destination state

- Threshold is $100,000 per year in gross revenue, or 200 transactions

- Shipping is taxed

Merchants are considered to have nexus in Kentucky if they:

- Physical presence nexus (including retail or trade shows for 15+ days per year)

- Inventory nexus

- Service nexus

- Property ownership nexus (including leasing)

- Employee nexus

There are no local tax rates in Kentucky, so the state tax is the only one you’ll need to worry about here. Kansas does recognize marketplace facilitators – only here, they’re called “marketplace providers”, while sellers are “marketplace retailers”.

Thresholds apply to current or previous year. Sales tax exemptions include food and medical supplies. Filing frequency depends on the average monthly tax liability of the seller, with those owing over $1,200 to file monthly.

Louisiana

- Destination state

- Threshold of $100,000 in revenue or 200 transactions

- Shipping is taxable under certain conditions

Louisiana recognizes nexus with:

- A physical location

- Employee nexus

- Inventory nexus

- Economic nexus

In 2018, Louisiana enacted an economic nexus law, but it didn’t take effect until July of 2020. Now, physical and digital products, as well as services are subject to the sales tax regulations. The filing frequency in Louisiana depends on the average monthly tax liability, and is either quarterly or monthly. As of August 2020, the state increased incentives to file and pay on time.

Furniture, groceries, and prescriptions are among the items exempt from sales tax, and items purchased for resale may be exempt with the appropriate certificate.

In the past, local jurisdictions had to be registered with separately for sales tax purposes. The state has now formed a Sales and Use Tax Commission for Remote Sellers to serve as a central collection hub. Currently, the extent of the commission’s activity is unclear.

The state is also considering a measure requiring sales tax collection and remittance of marketplace facilitators.

Maine

- Destination state

- Threshold of $100,000 or 200 transactions

- Shipping is not taxable if stated separately

Maine recognizes nexus when:

- Employees, salespeople, contractors or other representatives are present

- A place of business such as an office or store exists

- A warehouse is present

- The seller offers local pickup to buyers

Maine recognizes the following types of nexus for out of state sellers:

- Inventory nexus

- Employee nexus

- Economic nexus

Maine does not utilize local tax rates, so only the state rate needs to be considered. Additionally, services are not taxable (with some exceptions). Sales tax exemptions for physical products include groceries, medicines, and medical equipment.

Once you’ve registered to collect sales tax in Maine, the state will assign you a filing frequency, generally based upon the sales volume of your business. The more revenue, the more frequently you’ll probably have to file.

Maryland

- Destination state

- Threshold of $100,000 per year in gross revenue or 200 transactions

- Shipping is not taxable if stated separately

Maryland recognizes the following types of nexus:

- Physical presence nexus

- Employee nexus

- Inventory nexus

- Service nexus

- Property ownership nexus

Maryland does use local tax rates, so remote sellers only need to collect the state tax rate. Filing frequency may be monthly, quarterly, semiannually, or annually, depending on revenue and tax liability.

Sales tax exemptions may apply to resellers with the appropriate paperwork. Other exemptions include food, medication, and farm supplies.

Massachusetts

- Destination state

- $500,000 in the prior calendar year and at least 100 transactions in the state

- Shipping is taxable

Massachusetts recognizes the following types of nexus:

- Physical nexus

- Employee nexus (more than two days per year)

- Inventory nexus

- Trade show nexus (including samples or displays)

- Service or delivery nexus

- Property ownership nexus

Massachusetts is another state with no local tax rates, so remote sellers need only worry about the state tax rate.

Michigan

- Destination state

- Threshold of $100,000 or 200 transactions in the last calendar year

- Shipping is taxable

Michigan recognizes the following types of nexus:

- Physical nexus

- Solicitation nexus

- Ownership of a business with nexus

Businesses required to collect and remit sales tax may be required to file monthly, quarterly, or annually. Early filers may receive a discount.

Michigan offers exemptions on many products, and discounts on others. These include groceries and prescriptions (exempt) and clothing, food, and over-the counter medicines (discounted rates). Resellers may also obtain exemption certificates.

Minnesota

- Destination state

- Threshold of $100,000 in gross revenue or 100 sales in prior 12 months

- Shipping is taxable on taxable items

Minnesota recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Service nexus (Including agreements for referrals of Minnesota customers)

- Solicitation nexus

- Delivery nexus

Due dates for sales tax returns in Minnesota may be monthly, quarterly, or annually. Sellers must also be aware of varying local taxes in the state.

Fortunately, Minnesota recognizes “marketplace providers” a.k.a. marketplace facilitators. They are required to collect and remit sales taxon behalf of sellers, unless there is an agreement otherwise. In this case the seller must present their sales tax registration to the marketplace provider.

Sales tax exemptions in Minnesota include food, clothing, and both prescription and over-the-counter drugs.

Mississippi

- Origin state

- Threshold of $250,000 in prior 12 months

- Shipping is taxable

Mississippi recognizes the following types of nexus:

- Physical nexus

- Service nexus

- Solicitation nexus

- Economic nexus

Mississippi started taxing remote sales in 2017, making it one of the earlier states to enact an economic nexus law. These are subject to the regular retail rate of 7%. Although services are not usually taxable, products are. Sales tax exemptions include some prescriptions, medical devices, and manufacturing items.

Filing frequency in Mississippi depends on the average monthly tax liability, and may be monthly, quarterly, or annually.

Missouri

- Origin state

- Threshold of

- Shipping is usually not taxable

Missouri recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus (more than 2 days per year)

- Inventory nexus

- Property ownership nexus

- Delivery nexus

Missouri currently does not have any economic nexus laws. This means that remote sellers who do not have nexus through any of the above categories are not required to collect and remit sales tax.

Montana

Montana does not levy a sales tax, so there is no requirement for remote sellers to collect and remit it.

Nebraska

- Destination state

- Threshold of $100,000 or 200 more more sales in the current or prior calendar year

- Shipping is taxable

Nebraska recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus

- Inventory nexus

- Property ownership nexus

- Delivery nexus

- Economic nexus

Nebraska does recognize marketplace facilitators, by definition a person or entity who operates an Multivendor Marketplace Platform (MMP). However, all sellers who exceed the established thresholds must file a Sales and Use Tax Return. These are required monthly, quarterly, or annually depending on average monthly tax liability.

Remote sellers in Nebraska should be aware of local tax rates, as well as the state tax. Nebraska allows sales tax exemptions for groceries, medicine, and gasoline.

Nevada

- Destination state

- Threshold of $100,000 per year in previous year, or 200 or more transactions in current or prior year

- Shipping is taxable

Nevada recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus

- Inventory nexus

- Property ownership nexus

- Delivery nexus

- Economic nexus

In Nevada, services are generally not taxed. When it comes to physical products, exemptions to sales tax include groceries, prescription medicines, medical devices, and more. Resellers may acquire a resale certificate.

Remote sellers should take both local and state sales tax into consideration. Sales tax returns in Nevada are filed either monthly or quarterly.

New Hampshire

New Hampshire does not levy a sales tax, so there is no requirement for remote sellers to collect and remit it.

New Jersey

- Destination state

- Threshold of $100,000 or 200 transactions in prior or current year

- Shipping is taxable for taxable products; shipping on non-taxable items must be listed separately to be non-taxable.

New Jersey recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Employee or contractor nexus

- Delivery nexus

- Click-through nexus

New Jersey offers a helpful Sales Tax Guide for sellers to reference. It includes sections on sales tax law, as well as exemptions and refund information. Some exemptions include food and clothing. Exemption certificates can be found on the State of New Jersey’s Treasury website.

New Jersey requires sales tax returns to be filed either monthly or quarterly.

New Mexico

- Origin state

- No sales tax – “gross receipts tax” threshold of $100,000

- Shipping is taxable

New Mexico recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Employee nexus

- Solicitation nexus

New Mexico does not levy a sales tax, but rather a gross receipts tax. This is a combination of the state, county, and municipal rates. Beginning July 2019, remote sellers must collect and remit this tax if their sales reach the threshold in the current or prior year.

New Mexico, unlike many other states, does tax services as well as goods. Filing frequency is assigned by the state and may be monthly, quarterly, or semi-annually.

New York

- Destination state

- Threshold of $500,000 and at least 100 sales

- Shipping is taxable if the product is taxable

New York recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus

- Inventory nexus

- Property ownership nexus

- Delivery nexus

- Economic nexus

This Welcome New Vendors guide from the Department of taxation and finance is a great starting point to learning about sales tax in New York. Sellers can find out here whether they’ll need to file quarterly, annually, or “part-quarterly” (translation: monthly).

New York’s economic threshold only applies to tangible personal property delivered into the state. So, digital products and services may find a loophole in the state. Products which are specifically exempt from sales tax include some food and drinks, medical products and medicines, hygiene products, and more.

North Carolina

- Destination state

- Threshold of $100,000 per year in gross revenue, or more than 200 transaction in the current or prior year

- Shipping is taxable

North Carolina recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus

- Inventory nexus

Remote sellers with nexus in North Carolina must consider both the state sales tax rate, and the local tax rates. These rates apply to products as well as services.

Sales tax returns must be filed monthly or quarterly, depending on the average monthly tax liability. Products exempt from sales tax include groceries, some medical devices, and prescription medications.

North Dakota

- Destination state

- Threshold of $100,000 per year in the current or previous year

- Shipping is taxable

North Dakota recognizes the following types of nexus:

- Physical nexus (even temporary)

- Employee nexus

- Personal property nexus (including rented or leased)

- Economic nexus

North Dakota’s current remote sales tax rules went into effect in July 2019. Prior to this, the rule included the clause “and 200 or more transactions”. This part of the rules was repealed to that economic nexus now depends solely on gross sales volume, not transactions. Exemptions to sales tax include prescription drugs, fertilizers, and seeds for planting.

North Dakota is friendly to remote sellers in that only one return is required for state and local sales tax filing. These may be due monthly, quarterly, annually, or semi-annually.

Ohio

- Origin state

- Threshold of $100,000 or 200 transactions in the current or prior year

- Shipping is taxable

Ohio recognizes the following types fo nexus:

- Physical nexus

- Employee nexus

- Services nexus

- Delivery nexus

- Personal property nexus (including renting or leasing)

- Business nexus

- Economic nexus

In August of 2019, Ohio enacted a law requiring remote sellers to collect and remit sales tax on sales of tangible personal property or services. Ohio also recognizes marketplace facilitators who meet the threshold, and requires them to collect the effective tax rate at the location of delivery.

Groceries and prescription drugs are among the products exempt from sales tax. These may be due either monthly, or semi-annually.

Oklahoma

- Destination state

- Threshold of $100,000 in the previous or current calendar year

- Shipping is not taxable when listed separately

Oklahoma recognizes the following types of nexus:

- Physical nexus

- Contractor or representative nexus

- Inventory nexus

- Personal property nexus

- Delivery nexus

Oklahoma collects “sales tax” and “use tax”, which are often grouped together as “sales and use tax”, but which may be separate and may vary slightly. The latest rates for both are maintained by the Oklahoma Tax Commission. Sales tax exemptions include prescription drugs and purchases made with food stamps.

Oklahoma’s remote seller law also recognizes “referrers” or marketplace facilitators, who are remote and meet sales thresholds. If these entities collect and remote sales tax for a seller, then the seller is not responsible for sales tax on items sold through the facilitator. Sales tax may be filed on a monthly or a semi-annual schedule.

Oregon

Oregon does not levy a state sales tax. There are also no county or local taxes to account for.

Pennsylvania

- Origin state

- Threshold of $100,000 in the previous 12 month period

- Shipping is taxable on taxable items

Pennsylvania recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Inventory nexus

- Personal property nexus (including leasing)

- Delivery nexus

- Contractor nexus

It’s important to note that while the threshold to pay sales tax is $100,000, there is a “notice and report” threshold of $10,000. The requirements and guidelines for this report are outlined by the Pennsylvania Department of Revenue.

Sales tax exemptions include some food, clothing, textbooks, resale goods, and more. Sales tax returns may be filed annually, monthly, or quarterly, depending on the sellers average monthly tax liability.

Philadelphia and Allegheny counties also levy a local tax – however remote sellers are not required to collect and remit these local taxes if they are not located there.

Rhode Island

- Destination state

- Threshold of $100,000 or 200 transactions in a calendar year

- Shipping is taxable

Rhode Island recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Inventory nexus

- Delivery nexus

- Trade show nexus

- Clickthrough (affiliate) nexus

- Solicitation nexus (specifically advertising)

Starting July of 2019, Rhode Island began requiring remote sellers and marketplace facilitators to collect and remit sales tax. The threshold is the same for both, and applies to tangible personal property, services, or computer software delivered electronically.

Rhode Island has a statewide tax of 7%, so remote sellers do not need to calculate local rates. Sales tax in Rhode Island may be filed monthly, or quarterly. Sales tax exemptions include clothing and footwear.

South Carolina

- Destination state

- Threshold of $100,000 in prior or current year

- Shipping is taxable

South Carolina recognizes the following types of nexus:

- Physical nexus

- Employee or representative nexus

- Inventory nexus

- Personal property nexus

- Delivery nexus

- Contractor nexus

South Carolina has a state sales tax rate, and also allows counties to levy an additional 1% if they choose to. There are a number of items exempt from sales tax in South Carolina, including groceries and prescriptions.

Generally sales tax returns must be filed monthly, Quarterly and annual filings are allowed upon approval of the South Carolina Department of Revenue. It should be noted that sellers who owe more than $15,000 per filing period are required to pay electronically.

South Dakota

- Destination state

- Threshold of $100,000 in sales or 200 transactions in current or prior year

- Shipping is taxable on taxable products

South Dakota recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Solicitation nexus (“marketing activities”)

South Dakota’s threshold includes not only tangible personal property, but also services and electronically transferred goods. The state also recognizes marketplace providers and holds them to the same threshold.

In addition to the statewide tax, South Dakota allows municipalities to impose a local tax if they choose. Products exempt from sales tax include prescription medication, advertising services, and more. Sales tax returns are filed monthly by the 20th of the following month.

Tennessee

- Origin state

- Threshold of $500,000 in the previous 12 months (as of October 2020, this will be lowered to $100,000)

- Shipping is taxable on taxable items

Tennessee recognizes the following types of nexus:

- Business presence nexus

- Employee nexus

- Personal property nexus (including rental or lease)

- Contractor or representative nexus

- Economic nexus

Tennessee’s economic threshold is actually being lowered in 2020, from $500,000 down to $100,000. Sales tax rates for items like food and telecommunications are lower than the state tax rate, while gasoline, textbooks, some healthcare products, and products for resale are exempt.

Sales tax returns must be filed either monthly, quarterly, or annually. Local tax rates do apply, and can be found on the Tennessee Department of Revenue site.

Texas

- Origin state for in-state sellers, destination state for out-of-state sellers

- Threshold of

- Shipping is taxable

Texas recognizes the following types of nexus:

- Physical nexus (including sales room)

- Employee nexus

- Inventory nexus (including distribution)

Although Texas has a set state sales tax rate, local jurisdictions, including not only cities and counties but also special-purpose districts and transit authorities, may impose an additional 2% sales tax.

Products exempt from sales tax are those considered “necessities of life” such as food and health-related items. Resale and wholesale items are also exempt. Sales tax returns may be due monthly, quarterly, or annually. Returns that are filed on time or prepaid may net a discount.

Utah

- Origin state

- Threshold of $100,000 or 200 transactions in the previous or calendar year

- Shipping is not taxable is stated separately

Utah recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Representative nexus

- Affiliate nexus

- Economic nexus

Utah has a statewide sales tax as well as local and special-purpose taxes. The Sales Tax Commission offers charts showing and combining local, state, and other assorted sales tax.

Sales tax returns may be required to be filed monthly, quarterly, or annually. Exemptions to sales tax apply to products including but not limited to those used in food preparation,food stamp purchases, and some medical equipment.

Vermont

- Destination state

- Threshold of $100,000 per year

- Shipping is taxable

Vermont recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Solicitation nexus (marketing)

- Economic nexus

Vermont began to require sellers with economic nexus to collect and remit sales tax starting in July of 2018. Local rates may apply in addition to the state sales tax rate. Products which may be exempt from sales tax include clothing, medical equipment and supplies, food products, and over-the-counter medicines.

Sales tax returns are filed either monthly or quarterly. This is assigned by the Department of Taxes, but depends on the seller’s sales tax liability in the prior year.

Virginia

- Origin state

- Threshold of $100,000 or 200 transactions annually

- Shipping is not taxable when charged separately.

Virginia recognizes the following types of nexus:

- Physical nexus

- Employee or contractor nexus

- Inventory nexus

- Property ownership nexus (including leased)

- Delivery nexus (more than 12 per year not by common carrier)

- Solicitation nexus (except for by U.S. mail)

- Economic nexus

Virginia began requiring remote sellers to collect and remit sales tax in 2019, if they meet the sales or volume threshold. Marketplace facilitators are also recognized here, as are “marketplace sellers”, sellers who contract with marketplace facilitators to sell their products.

Local taxes are levied by cities in Virginia in addition to the state tax rate, so sellers will need to calculate local rates that apply to them. Virginia sales tax returns are filed either quarterly, or monthly.

Sales tax exemptions include certain advertising, medical equipment, and prescription drugs.

Washington

- Destination state

- Threshold of $100,000

- Shipping is taxable if the product is taxable and separate from non-taxable products

Washington recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Production or installation nexus

- Business nexus

- Personal property nexus (renting or leasing)

- Service nexus

- Delivery nexus

- Economic nexus

Washington’s economic nexus law went into effect January of 2020. The state also recognizes marketplace facilitators, who are subject to the same threshold.

Sales tax returns should be filed monthly, quarterly, or annually depending on the monthly average tax liability. Products exempt from sales tax include food, prescription drugs, and sales to Indians or Indian tribes.

Washington D.C.

- Destination state

- Threshold of $100,000 or 200 transactions in the current or previous calendar year.

- Shipping is taxable

Washington D.C. recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Employee nexus (representative, agent, or salesperson)

- Economic nexus

Washington D.C.’s economic nexus law took effect January of 2019. Luckily for remote sellers, the District of Columbia has no local rates to worry about, only the state rate. Sellers must begin collecting this tax as soon as they find their gross sales or transaction have reached the threshold. Marketplace facilitators are required to collect and remit sales tax here.

Groceries, prescription drugs, and over-the-counter drugs are exempt from sales tax. Returns may be required to be filed monthly, quarterly, or annually.

West Virginia

- Destination state

- Threshold of $100,000 and 200 transactions during a calendar year

- Shipping is always taxable

West Virginia recognizes the following types of nexus:

- Physical nexus

- Service nexus

- Employee nexus

- Solicitation nexus

- Economic nexus

West Virginia began recognizing economic nexus in January of 2019. Sales tax exemptions include items like prescription drugs, some medical goods and equipment, advertising, and intangibles (such as copyrights or royalties).

Marketplace facilitators are required to collect and remit sales tax in West Virginia, when total sales on behalf of third parties reach the threshold.

Sales tax may be filed Monthly, quarterly or annually, depending on the average monthly tax liability.

Wisconsin

- Destination state

- Threshold of $100,000 or 200 transactions in the current or previous year

- Shipping is taxable if the product is taxable

Wisconsin recognizes the following types of nexus:

- Physical nexus

- Employee nexus

- Inventory nexus

- Property ownership nexus

Wisconsin began requiring remote sellers with economic nexus to collect and remit sales tax in 2018. Marketplace facilitators are recognized in Wisconsin, and sellers are not required to register if all sales are made through a facilitator’s platform.

Wisconsin has a number of unique sales tax-exempt items: in addition to groceries prescription drugs, some agricultural items, medical devices, and manufacturing equipment may be exempt. Sales tax filings may be required monthly, quarterly, or annually.

Wyoming

- Destination state

- Threshold of $100,000 or 200 transactions

- Shipping is taxable

Wyoming recognizes the following types of nexus:

- Physical nexus

- Inventory nexus

- Representative nexus

- Solicitation nexus

It’s important to note that Wyoming’s solicitation nexus is quite comprehensive; even systematic solicitation by email may be construed as solicitation resulting in nexus.

In Wisconsin, local rates must be calculated as well as the state sales tax rate. Prescription drugs and groceries are exempt from sales tax, as are some agricultural products and manufacturing and mining equipment. Sales tax filings may be required monthly, quarterly, or annually, depending on average monthly tax liability.

Next steps for ecommerce Sellers

Like I said, sales tax for remote sellers is complicated. So you may be wondering what to do next. It all depends on what stage your business is at, so here are a few roadmaps for you.

Below Economic Nexus Thresholds

If you’re collecting sales tax in your home state, but you’re sure you haven’t hit economic nexus anywhere else, you’re in a great position to set up systems before you need to start collecting.

Track

To do this, make sure you have a system in place to track sales. During times of growth, periodically review your sales by state, as outlined above (Nexus in Another State). Most platforms have some way of downloading sales data, and knowing a few basic spreadsheet formulas can save you tons of time adding them up.

Research

Starting to watch and listen for companies and software solutions will give you a head start when you do reach that point of needing them. If you know other ecommerce sellers, ask for reviews and recommendations on solutions to use.

Prepare for a Nexus Study

As your business grows, be prepared to commission a professional nexus study (a comprehensive analysis of your sales data in all 50 states) which will tell you where you’ve hit nexus and need to register.

Not Paying Sales Tax, But Should Be

Start with a nexus study. If you’ve got more time than money, you could try to do it yourself, but if you have a large volume of sales, I don’t recommend it.

A Sales Tax Nexus study will use all of your sales data to tell you where you have economic nexus, according to current regulations. It can also take into account exemptions for products like food and clothing (where they apply). Generally a CPA or sales tax expert will conduct the study. At ECOM CPA, we have a dedicated sales tax specialist for this.

This study will allow you to find out if there are states where you may be delinquent and should file a past sales tax return. If so, your next steps will be to get the necessary permits in order, & start collecting sales tax.

Compliant, but Overwhelmed

Maybe you’re already registered, collecting, and remitting sales tax – but you’re overwhelmed by it. Monthly returns can be time consuming, especially if you need to do them in multiple states.

As we’ve covered, you have options when it comes to outsourcing, both automated and live. Which is the best fit for you will probably be a combination of time and money considerations.

To get started on a decision, get several quotes, and be sure to ask about the exact scope of each price tier – whether it includes collection, remittance, and filing, or just some of these.

The Bottom Line

As an ecommerce seller, properly collecting and remitting sales tax in each state is complicated and overwhelming for many sellers, but the cost of ignoring it is too high.

Perhaps the most complicated area is determining where you have sales tax nexus. Knowing the exemptions your product might qualify for also takes time and research. Remember that it is illegal to collect sales tax without a permit or registration in the state of collection, so this must always be done first.

Collection can be automated with a little work, but keeping up with filing deadlines and continually being aware of nexus threshold changes makes sales tax compliance a job in and of itself. This may be best outsourced to an automated service or CPA firm.

Regardless of the system you choose, as your business grows it;s important to set up a reliable system that is sustainable as you grow, so that you won’t fall into the cycle of late fees and penalties.