Selling an ecommerce business can be a very profitable move. You can use the proceeds to invest in other projects, launch new ecommerce business websites, or even retire. For some startups, selling the business is the end goal. Whether you have a dropshipping website, sell with Amazon FBA, or own a large-scale ecommerce business, there’s an opportunity for you to sell.

With the right strategy and know-how, you can market a successful website to interested buyers for a large sum of money. You should know some things first, such as what to value your company, how to present it, and the complex process of transferring ownership. In this article, we’ll cover it all.

Selling Brick-and-Mortar Vs. Ecommerce Businesses

Much of the value of a brick-and-mortar business is the actual brick-and-mortar. The location, amenities, and products are most important in many cases.

The Ecommerce business model, on the other hand, is done over the internet and has fewer tangible components, and tends to be more about the brand and history. While the domain has value like a physical storefront, it is less likely to be repurposed for something new. Instead, the buyer will usually want to keep things as they are, making less significant changes to improve what already exists.

Selling an online business often means selling the website, customers, and procedures you built to earn your success. In other words, you are selling your success to the new owner.

Methods of Valuation

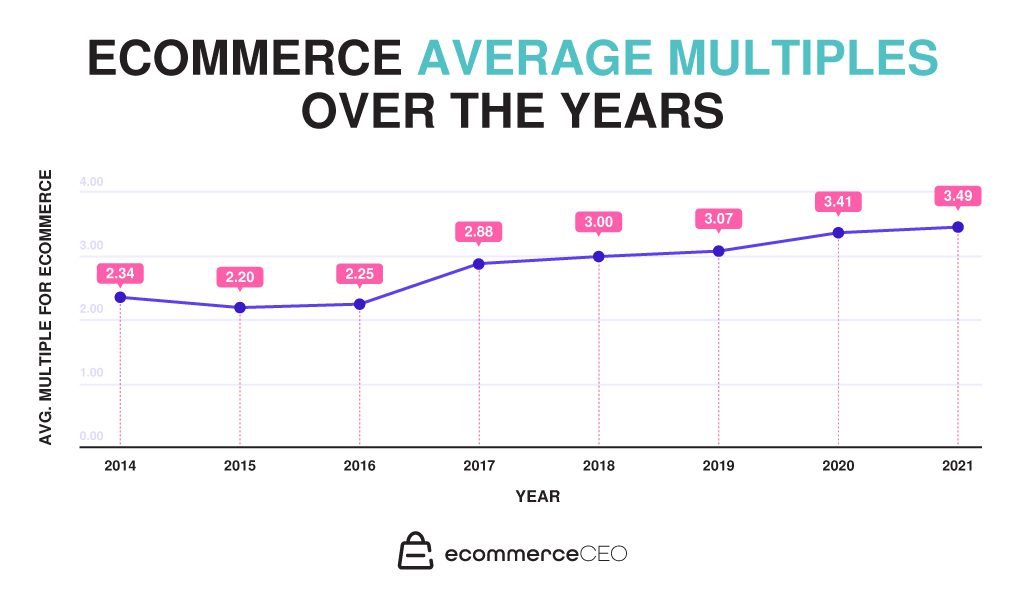

Determining an accurate business valuation is no easy task. Many factors, such as annual profits, outlook, and even the buyer, can affect it.

Say your business earns $250,000 a year. How much does that make it worth to a buyer looking for a healthy return on investment? Should they pay five times that amount, expecting the company will continue to grow over the next five years? Or maybe only twice that amount? What other risks need to be considered?

While there is no simple formula or valuation tool that will calculate a business’s exact value, some methods can help you estimate a fair selling price. Below are the most common methods business analysts use and how they work.

SDE Method

SDE stands for Seller’s Discretionary Earnings. It aims to measure the full financial benefit of the company by adding net income to certain optional or rare expenses. These expenses commonly include:

- The owner’s salary

- Discretionary expenses

- One-time expenses

Since the amount the owner pays themself is strictly for their own benefit, it can be included in the value of the company to the new owner. Discretionary expenses, which are optional to running the business, can also be added back as the new owner need not incur those costs. Lastly, one-time expenses that the new owner is unlikely to encounter again should be included.

EBITDA Method

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. This method works better for medium-sized businesses and larger businesses. It includes the following elements:

- Net income

- Interest expense

- Depreciation expense

- Amortization expense

- Taxes

This is a more standardized formula than the SDE method but is also more complex. EBITDA is usually used to compare the value of larger businesses (often with industry-dependant multipliers), while SDE gives a more accurate snapshot of what a small business owner earns.

The two formulas aren’t that different. The main difference is using a monthly net profit rather than an annual one.

Revenue and Growth-Based Valuations

The above methods may not work well for startups as the company may not have started earning profit yet. Instead, revenue is adjusted based on the business’s growth potential to generate a future-looking valuation.

For example, a company that earned $100,000 in the last year after a growth of 25% from the previous year might negotiate for $500,000 (five times the yearly earnings) due to anticipated growth. The multiplier isn’t an exact science, but a rule of thumb is to divide the percentage growth by about five. So 10% growth doubles the sale price, and 50% growth would multiply it by ten!

How to Get the Best Value for Your Ecommerce Website

Ecommerce business websites have a lot of different components. To land the best deal possible, you’ll want to do a thorough audit and look for improvements that can increase the value of your business.

Take a step back and consider your site from the angle of a buyer. What is impressive, and what needs work? Try to highlight the best features and improve the worst. Start with the relatively easy tasks that can significantly impact your site’s overall impression.

Refurbish Your Website

Your website is like the storefront of your business. Sprucing it up before selling it is like putting on a new coat of paint. With relatively little work, you can create a better impression that can help motivate buyers and could raise the sale price by thousands of dollars.

Here are a few worthwhile projects to get your ecommerce business ready for the sale process:

Update the UI

Maybe you’ve had the site for years without any major updates, or maybe there’s a small change you’ve been meaning to make but haven’t gotten around to. Either way now is a great time to make updates to your UI and improve your site’s user experience. You should do this before listing your business for sale, as it may look strange to interested parties if they notice last-minute changes. There are many ecommerce platforms that offer user-friendly design templates to improve your website.

You can expect any potential buyer to spend a fair amount of time exploring your site, as it is an integral part of your business. They’ll want to gauge your ecommerce website design to see if it needs work. Making ecommerce business sites as user-friendly as possible will improve your chances of making a good sale.

Make sure it’s Mobile-Friendly

Mobile shopping drives ecommerce. More shoppers use apps on mobile devices than traditional computer setups to make purchases online. If your website isn’t mobile-friendly, you’re not only missing out on sales, but potential buyers will need to do work to get your site responsive.

Keep it Intuitive

While you probably know your site like the back of your hand, including any quirks and intricacies, the new owner won’t. It is best to iron out as many wrinkles as possible so the buyer doesn’t have any trouble accessing the full potential of your site. They’ll want to see that your customers have an easy time with it and a minimal learning curve for themself.

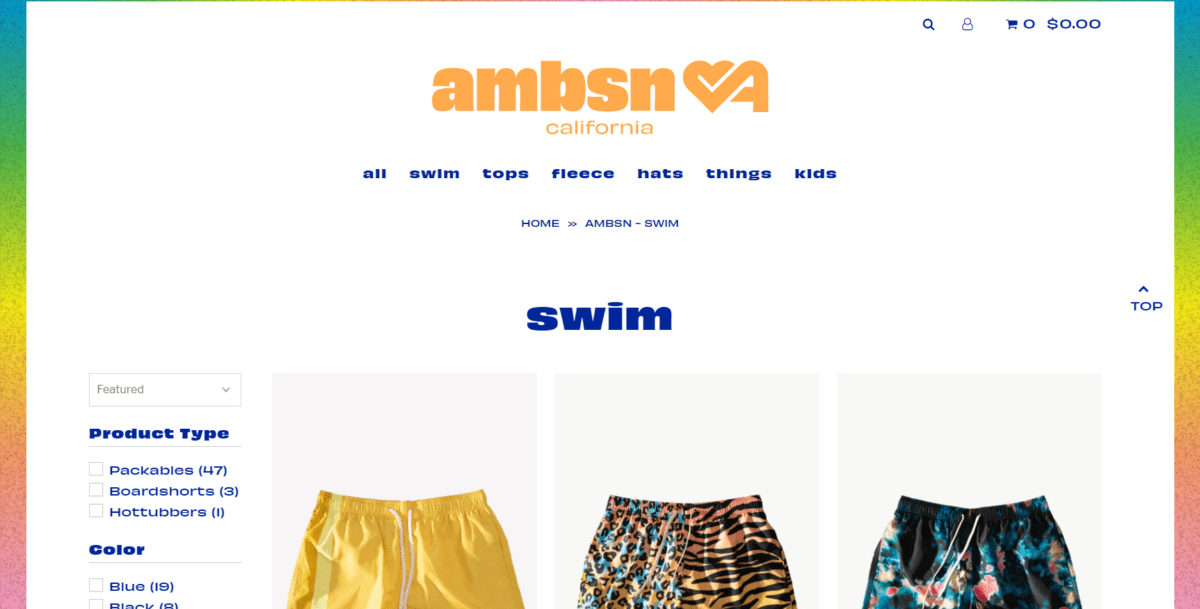

Update Your Stock

Preparing to sell a business is a great time to update your stock. You want your ecommerce store to look full and busy to prospective buyers, so go through and make sure everything is up to date, organized, and appealing.

Some essential tasks include:

Check for Out-of-Stock Products

While it may seem logical not to order new stock during the selling process, it is actually quite the opposite. The buyer will likely want to keep things running without losing any momentum. After all, part of the acquisition is likely to continue the success you have built.

Not only do you want the new owner to be able to continue to operate without delay, but a web shop with a ton of “out of stock” tags gives the same impression as a brick-and-mortar store with empty, dusty shelves. To get top dollar for your ecommerce business, you want your store to look like it’s thriving and taken care of.

Condense Product Categories

Preparing to sell your ecommerce business is a great time to clean up your inventory. This can include the following tasks:

- Remove old products you no longer sell

- Hide or reorder out-of-stock items

- Reorganize remaining products (condensing categories where sensible)

- Delete product, sales, and landing pages that are no longer relevant

- Audit menus and directories to remove old links

You may think having as many products and categories as possible will make your site look impressive, but if many of your SKUs are out-of-stock or your categories bare, it may look neglected.

If you have any categories with only one or two products in them, consider consolidating them into other groups.

Optimize and Update Product Images

Preparing your ecommerce store for sale puts you in a prime position to go through and clean up the minor details you may not have had time for during your regular operation. For example, you may have just been grabbing the most accessible images for your products and quickly adding them to new product pages along with simple product descriptions.

Image optimization improves site performance and search engine optimization (SEO). Poorly optimized images can drastically affect page load times and user experience. This commonly occurs when the images provided by the manufacturer are much higher quality than needed or use a format without compression (such as PNG vs. JPEG or WEBP).

Establish SOPs

When purchasing online businesses, buyers don’t want to reinvent the wheel. They aren’t just buying your website and stock; they are buying the entire company, including the success and momentum you have built.

In order to continue your success, buyers will want to know how your business process so they can continue the operation as seamlessly as possible. To do this, they need standard operating procedures.

SOPs spell out how to accomplish tasks within your business. Having business processes and methods well-documented allows the new owner (and possibly new employees) to quickly get up to speed and keep the company on track. Think of this like an instruction manual for your business.

You will have a much better sales pitch if you can say, “here is how much we made last year and here’s how we did it,” than if you just say, “here’s the password to the site; good luck.”

Get Your Financials Organized

Buying a business means accepting all of the debt and credit that comes with it. In addition to proving the revenue and profit margins you claim for the valuation of your business, you will need your bookkeeping to be clean and easy to follow so you aren’t handing off a can of worms to the new owner.

This means getting all of your financial records up to date, cleaning them up, organizing them so that a new accountant can make sense of them, and preferably making them available on modern business accounting software.

This way, you can hand off an easy-to-follow balance sheet to the new owner with proof of your business’ success.

Consider Hiring a Professional

There may be some aspects of the financials that you are not an expert on as the owner. Having an accountant or tax professional help could be well worth it.

You may even consider getting help from an ecommerce broker who understands the online business acquisitions and sales process. They will likely be able to help with your financials and other aspects of the deal.

Organize Customer Info

As we’ve already said, the buyer isn’t just purchasing your ecommerce website; they are buying your entire business. This includes your customer base and data. Customers are the lifeblood of ecommerce; without them, the company is an empty shell of what it was.

Cleaning up customer information is vital for giving accurate figures about your business’ value and allowing the new owner to continue operating effectively. For example, without a customer email list and purchase histories, the new owner’s marketing capabilities will be severely limited.

Remove Duplicates

In order to provide accurate figures about the size of your customer base, it is important to remove duplicates than may be artificially elevating the numbers. This will help clean up the list of more active, actionable accounts.

It will also prevent the new owner from sending duplicate communications to the same customers, which could look spammy.

Take Away Inactive Contacts

Inactive contact information can also artificially inflate the size of your customer base. An email address from a single purchase years ago that was never returned doesn’t have the value of a recent, repeat customer.

Removing or quarantining inactive contacts will give the new owner a clearer and more actionable list.

Make Sales & Traffic a Priority

Two of the key drivers for business valuation are sales and traffic. Sales are obvious because they correlate directly with revenue, but traffic is also crucial as a measure of the business’ potential. Even if visitors don’t make a purchase, their traffic is still valuable to a website.

Boosting sales will raise the numbers along with the profitability of your ecommerce business. You can do this through sales, marketing campaigns, or just continued, steady business.

Traffic stats can be improved through an SEO audit, paid marketing, or social media campaigns. The new owner may have different ideas about how to monetize your website, so being able to drive significant traffic to your site gives them more options (thus making your business a more valuable acquisition).

Hire a Third-Party Appraiser

The art of the sale is a balancing act. The seller wants to get the most out of the deal, while the buyer wants to pay the least they can. To alleviate some of the tension and frustration of these negotiations, a third-party appraiser can help determine a fair value for your ecommerce business to help all parties reach a fair agreement.

Find an Ecommerce Broker

An ecommerce broker is someone with experience selling established ecommerce companies. They will assist you with a valuation, drafting documents for the sale, and even marketing your business to potential buyers. Think of an ecommerce broker as a real estate agent for your business.

Go Out and Look For Qualified Buyers

If you decide not to use a broker but are motivated to sell, you can seek qualified buyers on your own. Some ecommerce business websites make for an easy sale, while some niche online stores may have more trouble finding the right buyer.

You can try contacting large companies under the same umbrella, which may be looking for more revenue streams or traffic diversity. You can even consider direct competitors looking for a larger market share. There may also be conglomerates eating up smaller businesses to add to their offerings.

The trick is finding someone willing to pay for an established business. If you are struggling to find leads, consider checking out business marketplaces such as Flippa. Be sure to have sales figures, monthly profits, and valuations ready to entice interested buyers.

Consider Hiring a Sales Rep

If you want help making the sale, consider hiring a sales representative. Usually, for a reasonable commission, a sales rep will do the leg work to drum up potential sale opportunities and find you the best offer.

Not only will this save you time, but a talented salesperson could even get you a better price.

Complete the Sale

Once you have an interested buyer at a fair price, you can begin the actual transaction. An ecommerce brokerage or sales representative can assist you with drafting documents, negotiating a purchase price, and communicating with the buyer. However, you will probably want an attorney to facilitate the actual sale.

Hire a Qualified Attorney

There are many facets of selling a business. There is more to it than just exchanging money and a handshake. Legal documents need to be signed transferring ownership of the business entity along with any other aspect of the company, such as:

- Physical inventory

- Physical real estate (such as a warehouse)

- The website and domain name

- Trademarks and copyrights

- Customer lists and information

- Business records and data

- Licenses and contracts

- Software and passwords

In most cases, the buyer is purchasing everything you used to operate the business and achieve the valuation you did. If you are not also selling things like physical inventory or specific intellectual property, that will affect the valuation.

The legal documents drafted by an attorney will ensure that everything agreed upon is legally transferred to the buyer per any terms or conditions both parties have accepted. Without professional legal advice, the deal could fall through, or there may be unexpected complications that could affect either party.

Transitioning After the Sale

Once the deal is complete, and the papers are signed, you will need to transition all agreed-upon items and information to the buyer. This should be spelled out in the documents drafted by attorneys or reputable brokers, making for an easy transition.

Assisting the New Owners (Contingency)

In some cases, the buyer may request that the seller and other employees remain with the company for a period of time to assist in the transition. This post-sale support helps the new owner with questions and obstacles while they settle in.

If agreed upon, there will be terms for how the seller will assist the new owner in keeping the business running smoothly until they are ready to assume complete control. Again, this should be spelled out in the legal documents and contracts of the sale. Some sellers even stay with the company after the sale, filling another position while surrendering ownership to a new buyer.

Think About Your Reputation Post-Sale

There are many reasons to sell an ecommerce business, which will affect your next steps after the sale. You may be:

- Getting out of the game: This could be retirement or pursuing another career path. Selling your business is the end of the journey, and you are ready to walk away.

- Starting a new website: You may be selling one project to focus on another or launching something brand new. In this case, consider any connection between the website you are selling and whether you need to retain any copyrights or branding, which may mean severing connections between the two entities if they exist.

- Stepping down, but not out: You may pass the torch to the new owner but still remain part of the company. In this case, consider your new position and how you represent the company.

It is not uncommon for business owners to have their name attached to their company. For example, if your name is part of the company, will it be changed or kept by the new owner? You may have to agree to give those rights and consider how your other ventures will interact with the company you sold but still may retain your name, branding, image, or partnership.

Common Mistakes When Selling an Ecommerce Business

Selling your business is a big deal. Below are a few common mistakes first-time sellers make and how to avoid them:

Impulsive Selling

Seller’s remorse is real, especially when what you’re selling is also your job. For many individual business owners, their company is a big part of their life and identity. Selling your ecommerce business is not just about the dollar signs: it will likely be life-changing.

Some ecommerce owners are enticed by a large check and think it makes financial sense to sell their company, only to find themselves missing the work and unable to find something to fill that void. Others have a personal attachment to the business they built with their own blood, sweat, and tears and regret seeing someone else take the company in a new direction.

Selling a business is a big deal and not easily undone. Be sure you are certain before taking the money.

Agreeing Not to Get Paid Upfront

You should make the transaction as foolproof as possible, including upfront or immediate payment. A business isn’t a tangible thing, so if you start signing over rights and assets or sharing sensitive account information like passwords, it can be a hassle to get them back.

The last thing you want is to hand over control of your website without receiving payment. The buyer could do irreparable damage, if you are able to recover your account at all. Make sure they hold up their end of the deal before handing over sensitive information.

Not Having a Strategy in Place

For such an important transaction, you need to have an ironclad exit strategy. Since a large sum of money may be on the table, you don’t want to overlook anything that could end up costing you.

This is where a business broker comes in. They have the experience and expertise to know what your company is worth and how to get it. Conglomerates may come in with lowball offers, hoping you will accept them for a quick sale, but this could end up losing you a lot of money. Do your research, come up with a strategy, and get help if needed to ensure you sell for a fair price with good terms.

FAQs

Why Sell Your Ecommerce Business?

There are countless reasons ecommerce businesses are sold. Two of the most common are money or retirement.

va If they are successful or build a strong foundation, a buyer may come along and offer a large lump sum to take over the company. This can be a quick way to turn a huge profit.

Many people simply pass the torch when they are ready to retire or move on to a new business. Rather than just let the business they’ve built rot away, sell your success to someone else interested in continuing the operation. You may also take that money to invest in other projects.