Jeff Bezos is the richest man in the world. And his company, Amazon, is making a massive dent in the U.S. GDP.

If it seems like Amazon is everywhere these days, it’s because the company is doing way more than it used to, and continues to grow.

Yes, they sell millions of products, but they do so much more.

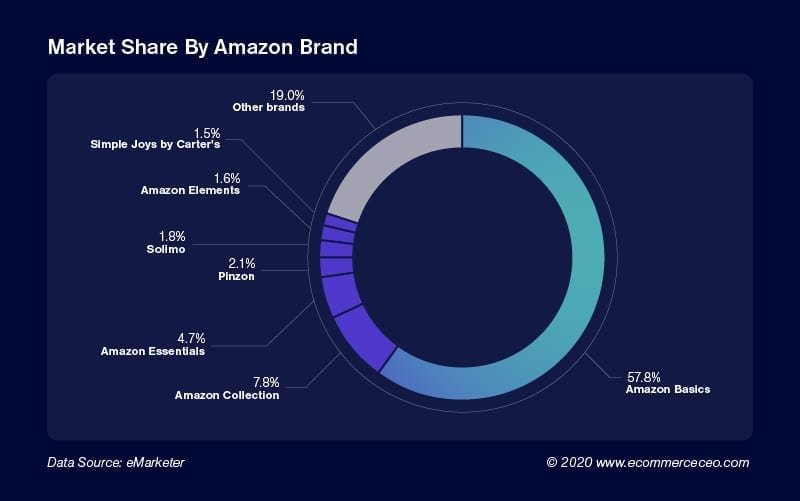

They have a variety of branded products, including the Amazon Kindle, Amazon Fire, and Amazon Echo. They’ve also invested many resources into their private label products in many niches, such as AmazonBasics, Presto, and Rivet. Across the board, their brands cover everything from automotive and sports and outdoors, to food and beverage, household essentials, health and wellness, and more.

If you can think of it, chances are, Amazon’s involved in it somehow. Amazon’s growth is a clear indication of just how rapidly ecommerce itself is growing, but selling on Amazon may not be the best option.

Why? Not only is there increasing competition between third-party sellers, but Amazon itself might also be cheating.

Let’s dive into the statistics so you can see how their dominance crushes the competition.

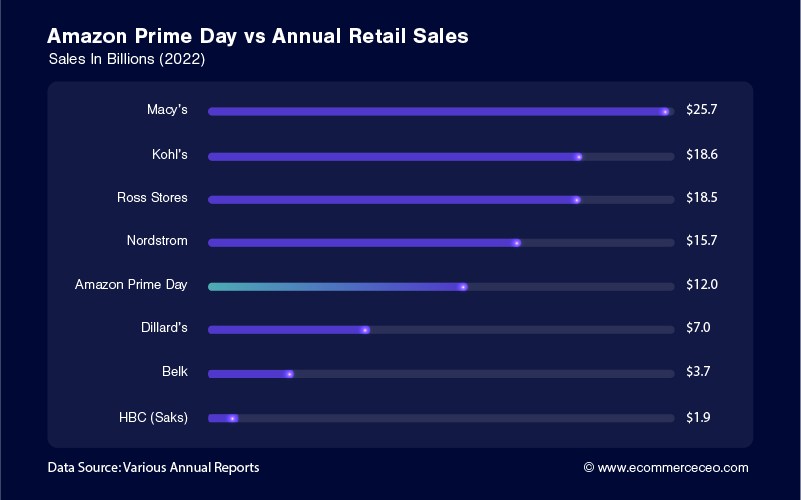

Crushing Stat: Amazon Prime Day Beats Annual Competitor Sales

It’s not fair to compare Amazon’s annual sales to the competition. For a meaningful comparison – you have to look at a single day sales initiative (Amazon Prime Day) vs. the annual sales of publicly traded retail corporations. Amazon generated more revenue on Prime Day than Belk or Dillard’s in their entire fiscal year. (Forbes, Dillards)

Yeah – we’re talking about a single day vs. all the sales in a single year. That’s how disproportionate ecommerce has become.

When you add up all the retail sales from the 9 brands above, it is less than 1/2 of Amazon’s annual revenue, which takes me to the next killer stat.

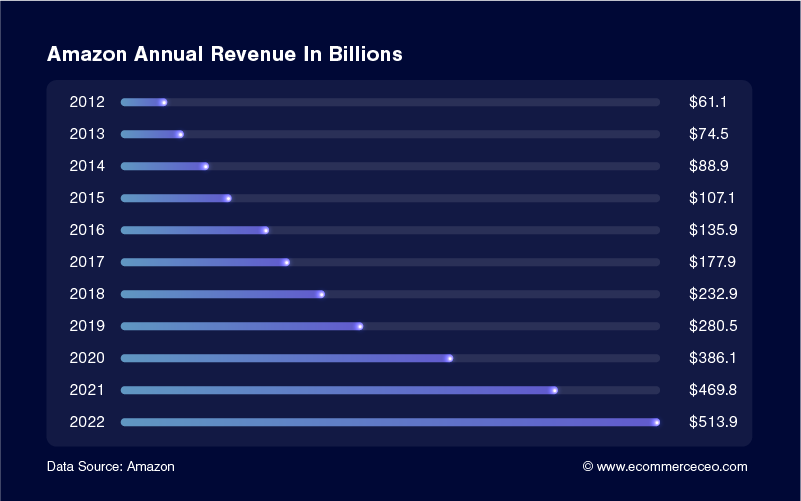

Amazon’s Revenue Climbed Over 1000% In the Past Decade

By making substantial investments in launching a new line of Echo devices, expanding Amazon Fresh to additional cities, and expanding on Prime Wardrobe, Amazon’s revenue continues to grow. It’s showing no signs of slowing down.

This rapid growth and initiative to drive prices lower is turning traditional retail on its head.

Additional Revenue Stats

- 2019 Annual Revenue was $280.52 billion, up from $232.89 billion in 2017. (Amazon)

- Amazon Web Services accounted for $9 billion in revenue in Q3, up 34.7% from a year earlier. (Amazon)

- Amazon’s advertising business brought in $3.586 billion in 2019 Q3. (Amazon)

- Amazon’s subscription revenue, including Prime fees, was $4.957 billion. (Amazon)

Amazon’s Dominating Ecommerce Market Share Will Continue to Grow

Amazon maintains that they’re not knocking out the competition – claiming they account for less than 4% of retail and pointing to Walmart being much more significant. But, politicians are calling for increased regulation on Amazon.

Amazon is using its monopoly in online sales to force companies to raise prices at its competitors like Walmart. That’s bad for families and another reason we need to #BreakUpBigTech. https://t.co/yblxJ2UA7V

— Elizabeth Warren (@ewarren) August 7, 2019

- In 2019, Amazon accounted for 47% of the U.S. ecommerce market, representing nearly 5% of all retail spend in the country. Walmart, on the other hand, only accounts for 4.6%. (eMarketer)

99% Of Amazon Sellers Make Less Than $1M Annually

Amazon is a highly fragmented marketplace where millions of sellers make little to nothing. When you think of all the products being sold and billions of dollars being made on Amazon – it’s crazy to think that less than 1% of the 3 million sellers make more than $1M per year.

With only 280,000 of them making more than $100,000 a year, it’s easy to see why the top brands opt for other channels (Marketplace Pulse).

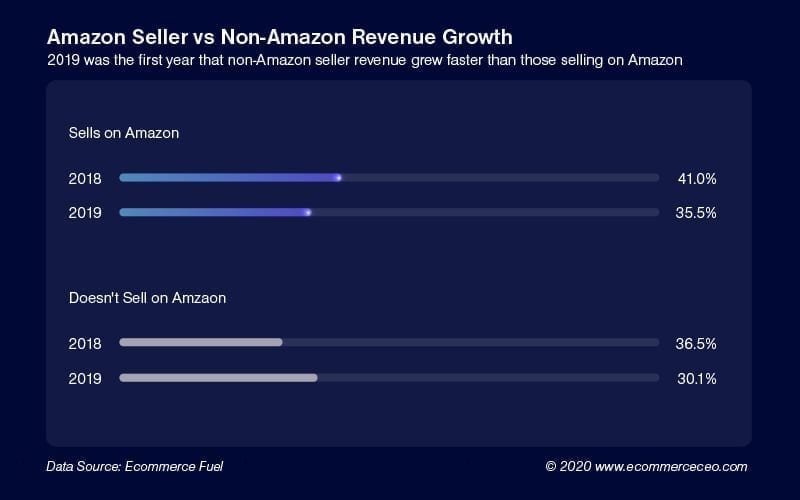

Merchants selling on Amazon barely made progress in 2019, moving from 55.2% to 55.8%. The percent of sales coming from Amazon also stagnated, barely moving from 27.6% in 2018 to 28.2% in 2019. Both metrics saw a significant jump from 2017 to 2018, and for the first time, stores that aren’t selling on Amazon grew faster as a group than those selling on Amazon. In other words, now’s not a great time to be an Amazon seller. (State of the Merchant Report, 2019).

Amazon Seller Stats

- About 80% of Amazon Marketplace sellers also sell on other platforms, given the pros and cons of the platform. (Vox)

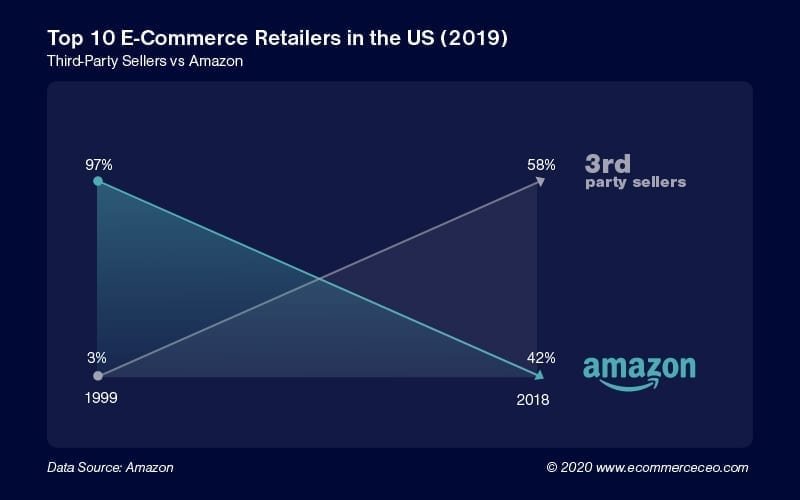

- Bezos noted in the 2018 annual shareholder letter that third-party sales have grown from 30% of the total sales on Amazon in 2008 to 58% in 2018 courtesy of the compound annual growth rate of 52% since 1999.

- ⅔ of the top 10,000 Amazon sellers use the fulfilled by Amazon (FBA) service. (FeedbackExpress)

- Major brands, such as Ikea, Nike, Popsockets, and Birkenstock, have decided to stop selling their products directly on Amazon due to concerns with the high number of counterfeit products on the site. (CNBC)

Despite the Amazon seller market being highly fragmented, Jeff Bezos still sees it as a threat.

In fact, after this letter, Amazon launched an additional 100+ private label brands as a counter.

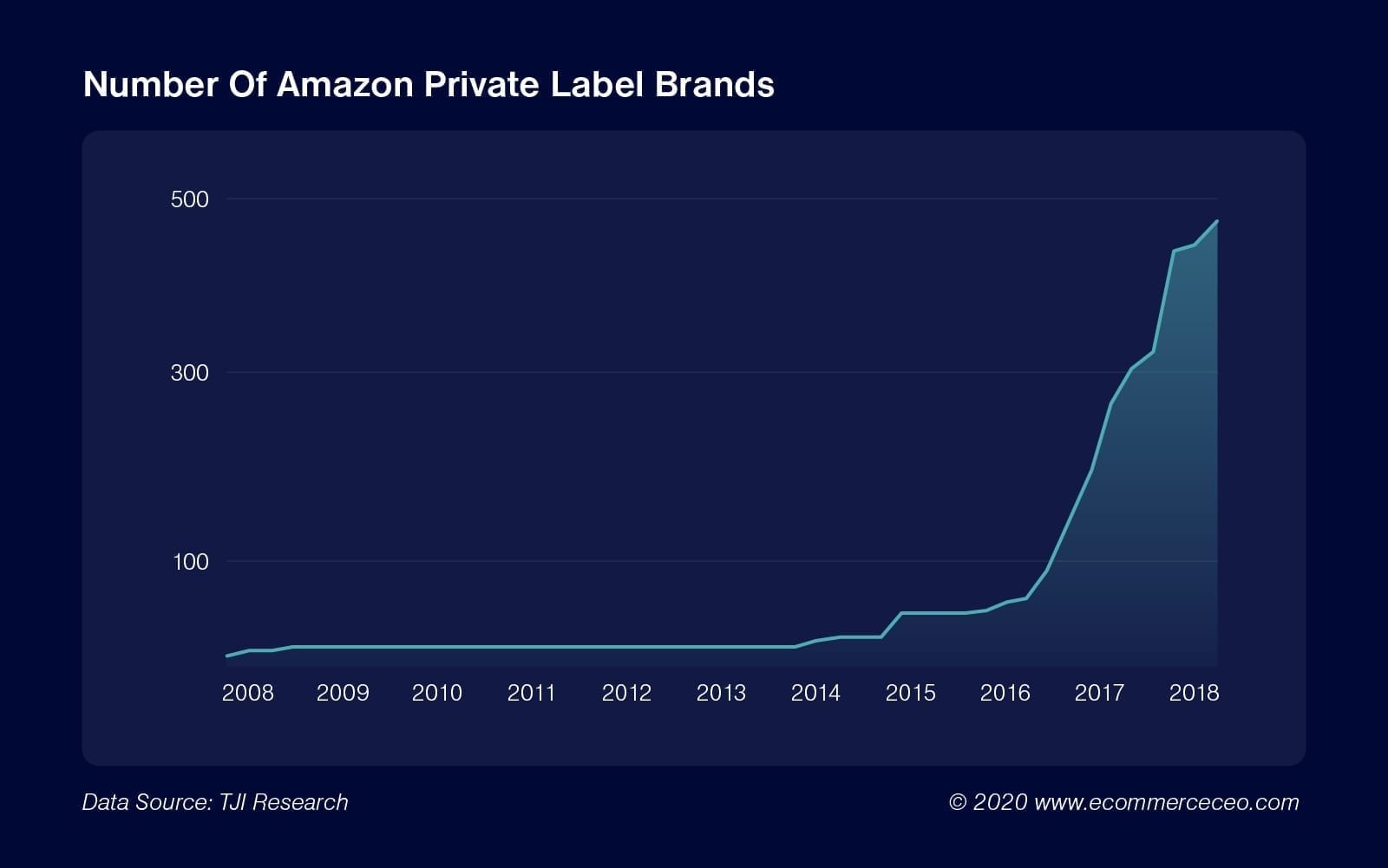

Amazon’s Growth In Private Label Brands Will Knock Out Smaller Players

So what happens when Amazon launches their own brand in a popular product niche?

The WSJ suggests Amazon will promote their products over competing brands.

Amazon owns 146 private label brands and 234 exclusive brands in the U.S. alone. When deciding on what to sell on Amazon, it’s essential to look at the private label brand offerings Amazon offers that would compete with your product. The private labels are often priced lower, a significant selling point for consumers. Use an Amazon Keyword Tool to take a look at what people are searching for, and then do a bit of digging to see what’s already there, before you start to offer your own products.

According to Marketplace Pulse, an Amazon spokesperson has said, “Amazon’s private label products are less than 1% of our total sales. This is far less than other retailers, many of whom have private label products that represent 25% or more of their sales. “

Despite this, the existence of their private label brands creates competition for the smaller sellers. Rain Design, for instance, has been selling an aluminum laptop stand on Amazon for more than ten years. A best-seller in its category, the $43 product had 2,460 reviews and a five-star rating. In July 2019, a similar product, from AmazonBasics, appeared at about half the price (Bloomberg). As a result, sales of the original declined, and there’s nothing the company can do because Amazon didn’t violate the patent. Though the laptop stand seems to be outselling the copy now, Amazon launched a different product priced at 19.99 that surpasses them both.

Williams-Sonoma sued Amazon last year because the Rivet line that sells furniture and housewares sells “knock-offs” of their West Elm brand products. The Rivet brand includes many products that are “strikingly similar,” and as a result of the suit, Amazon has stopped selling some of its Rivet products.

Stats On Amazon Brands

- Research indicates that the top 10 most successful private label brands Amazon owns, including AmazonBasics and Pinzon, contribute 81% of total sales. (Marketplace Pulse)

- The most successful private label brands other than AmazonBasics and Pinzon include Amazon Collection, Amazon Essentials, Solimo, Amazon Elements, Simple Joys by Carter’s, and Good Threads. (Marketplace Pulse)

- In 2019, the company added more than 100 brands, but none of them became category leaders. (Marketplace Pulse)

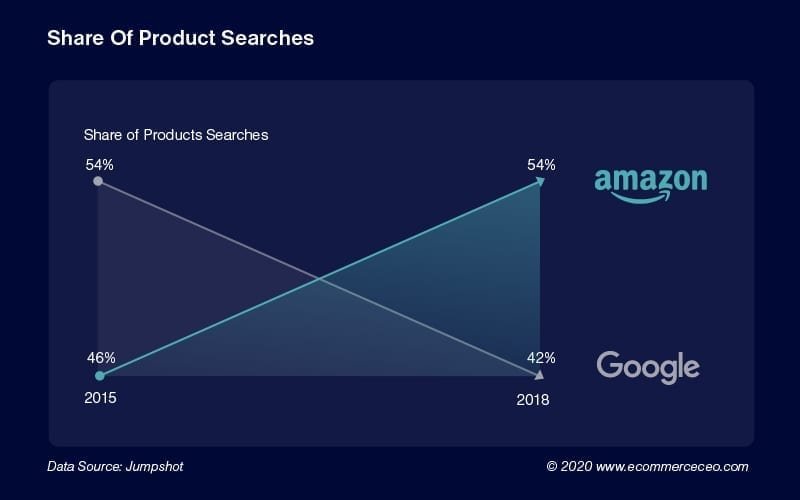

Amazon is the 14th Most Popular Website in the World

As of January 2020, Amazon is the 14th most popular website in the world, behind Google, YouTube, Facebook, Gmail, Yahoo, and Wikipedia. It is the most popular ecommerce website online. (Alexa). In terms of ecommerce, most people start their search for products on Amazon (Jumpshot).

Amazon Traffic Stats

- 82.09% of Amazon traffic comes from the US. 60% of shoppers are male. (SimilarWeb)

- As of April 2023, the site received 2.2B visits, a 5.41% decline from the previous month. (SimilarWeb)

- Visitors spend an average of 7 minutes and 9 seconds on the site when they visit, and it has a 34.43% bounce rate. (SimilarWeb)

- 87% of consumers are more likely to buy products from Amazon than other e-commerce sites, with 52% visiting Amazon daily or at least a few times a week. (FeedAdvisor)

- 61% of U.S. shoppers start their search for products at Amazon, compared to 49% using a search engine and just 32% using Walmart. (Insider Intelligence)

- 78% of Amazon searches are unbranded (Marketplace Pulse)

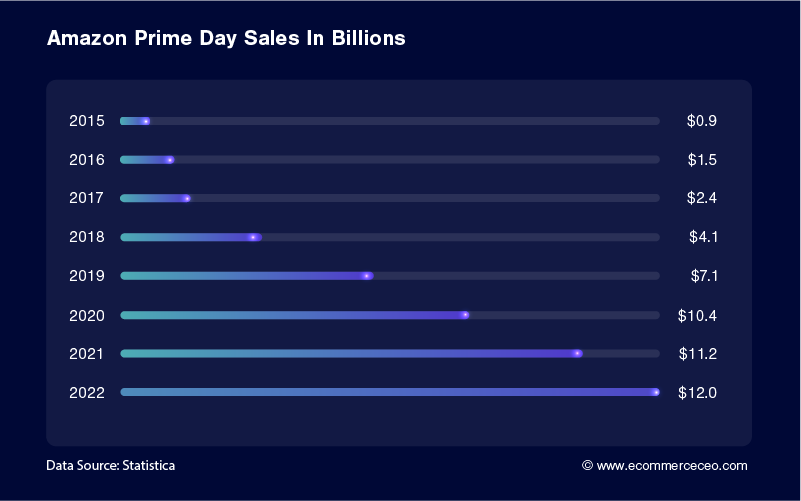

Prime Day Beats Black Friday & Cyber Monday

First hosted in July 2015 as a way to celebrate the company’s 20th anniversary, Prime Day was advertised as featured deals only for Prime members. Though the first year was likened to a “crappy yard sale,” the company stepped up its game in 2016 and beyond.

Amazon Prime Day is even bigger than Black Friday and Cyber Monday, and 2019’s day was the largest shopping event in Amazon history, according to CNBC.

Additional Prime Day Stats:

- During Prime Day 2022, Amazon customers spent 12 billion dollars, up from 11.2 billion in 2021, and 10.4 billion dollars in 2020. (Statista)

- In the U.S., top-selling Prime Day 2022 products were the Apple Watch Series 7, diapers and wipes, kitchen items, VTech and Leapfrog toys, and college whey. (Amazon)

Amazon Still Dominates Books

In the early days, Amazon was just an online bookstore. Founded July 5, 1994, it officially opened for business on July 16, 1995. Within a month, the retailer had shipped books to all 50 states in the U.S. and 45 countries. Amazon’s rise led to the fall of brick-and-mortar bookstores like Barnes & Noble.

Amazon Book Sales Stats

- As of March 2021, Amazon sells 75,138,297 products available for sale in its online marketplace. The largest category is Books, where there are 57.2 million. (ScrapeHero)

- 67% of respondents in the US and 71% in the UK have purchased a book on Amazon in the last 12 months (Statista)

Expect More AmazonBasics For Generic Products

In 2009, Amazon launched its private-label brand, AmazonBasics. In a matter of a few years, they’d grabbed nearly ⅓ of the online market for batteries, selling more than both Energizer and Duracell on their site. (Marketplace Pulse).

- AmazonBasics represents less than 5% of Amazon’s private-label products launched, but more than 57% of sales. (Marketplace Pulse)

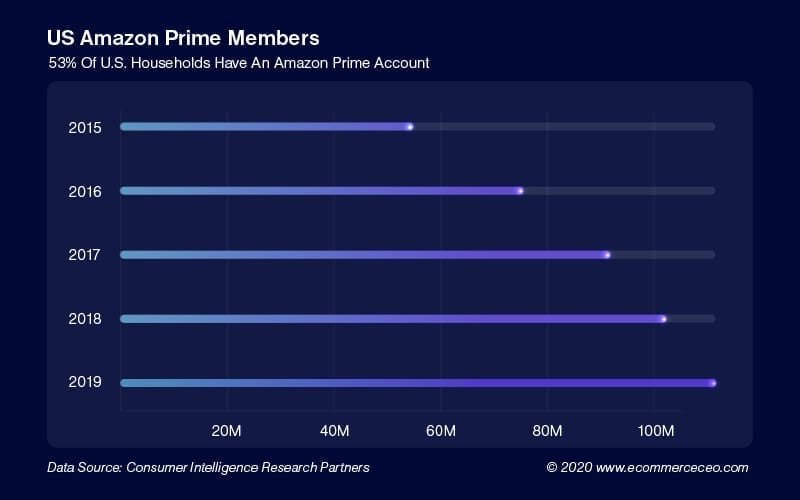

Crushing Stat: Amazon Has 53% Of U.S. Households Credit Cards On File

In the United States, there are approximately 128 million households, 68 million of those (53%) have Amazon Prime accounts.

A paid subscription service by Amazon that gives online shoppers access to otherwise unavailable services, or cost extra, for typical customers. Benefits include free one-day (on some items) or two-day delivery (on many more items), streaming music and video, access to Prime Pantry, and more.

Amazon Prime has approximately 112 million total members’ credit cards on file, ready for 1-click buying.

First launched in February 2005 at $79/year, the price is now $139/year. Members can also pay by the month, at $14.99/month. Users interested in just Prime Video can pay $8.99/month. Discounts are available for students and EBT, Medicaid, and other government assistance program recipients. (CNN, Amazon)

Amazon Prime Stats

- As of November 2022, there are an estimated 153 million Amazon Prime subscribers in the United States. (Statista)

- On average, those members spend $1,400/year. Customers of Amazon who are not Prime subscribers spend around $600/year. (Statista)

- In 2018, there were a total of 58.7 million U.S. households that have a Prime membership. It is expected to reach 68.7 million homes by 2020. (Statista)

- 65 percent of U.S. Amazon shopping users were also Amazon Prime subscribers as of September 2021. (Statista)

- As of February 2019, 20% of Prime members report shopping every week, while 7% of them buy almost daily. (Statista)

3rd Party Sellers Will Continue to Feed the Amazon Money Machine

Bezos noted in the 2018 annual shareholder letter that third-party sales have grown from 30% of the total sales on Amazon in 2008 to 58% in 2018 courtesy of the compound annual growth rate of 52% since 1999.

- $22.9 billion of Amazon’s revenue comes from Amazon Sellers fees.

- Amazon generated $42.75 billion in third-party seller service revenue in 2018, compared to $31.88 billion in 2017. (Statista)

Amazon isn’t Just ECommerce Anymore

Amazon has physical store locations, in addition to Whole Foods Markets, all over the country. Though Amazon used to have Books stores, 4-Star Outlets, and Pop Up sites, Amazon closed all 68 of these stores in 2022, according to the Verge.

- 500 Whole Foods Markets (Whole Foods Markets)

- 19 Amazon Go Convenience Stores across four cities (Amazon)

- 23 Amazon Go Convenience Stores across four cities (Amazon)

Amazon Cutting Out FedEx, UPS, and USPS

To rely less on other companies to deliver their products, Amazon is now handling its shipping for 26% of online orders, according to research firm Wolfe Research. (CNBC)

- Amazon Air has planes at more than 20 U.S. airports and will open a new hub at the Cincinnati/Northern Kentucky Airport in 2021. (TechCrunch)

- The company is on track to reach 70 planes by 2021. (TechCrunch)

- The company is making it possible to start your own business as an Amazon Delivery Service Partner, where drivers lease Amazon vans to deliver packages. (Amazon Logistics)

- For those who don’t want to start their own business, there’s the option to deliver packages with Amazon Flex with your vehicle. (Amazon Flex)

Is Amazon A Monopoly?

The Amazon Effect, or the ongoing disturbance in retail as a result of Amazon’s existence, is real. Are they a monopoly? The courts will have to decide that.

Apparently Jeff Bezos enjoys being a political lightning rod. He purchased the Washington Post, and the amount of taxes his company pays always attracts scrutiny.

If I could steer more of my money away from wasteful government spending and put $10 billion into climate change, I would, too.

When it comes to Amazon’s complete domination of sales, logistics, warehousing, and manufacturing for multiple product segments. I say:

Don’t hate the playa hate the game

Ecommerce is Jeff Bezos’ game. If you are selling on Amazon you’re playing by his rules. If Amazon existed before Jeff Bezos, I don’t think he would be selling on Amazon. He wouldn’t waste his energy on a platform he didn’t own.

There’s still good news for small businesses, though. Amazon may be impacting smaller sellers, but it’s just changing how people buy and sell products online. With the right product-market fit and ecommerce platform, you can still rock your way to ecommerce success. Just make sure you carve out an online business model outside of Amazon. You can even join the giving economy and donate to causes important to you and your customers with an app like ShoppingGives.

Selling on Amazon is a great avenue to learn the ropes and test products, but don’t expect to grow past 6 figures, though. You need to attract and convert your own traffic to build a brand that lasts.