Financial technology, or fintech, is the digital products and services disrupting traditional financing processes across many industries, including ecommerce.

See how fintech is now part of our daily lives and helping advance online selling.

What is Financial Technology – Fintech?

At its core, financial technology aims to provide more flexible, faster, and better financial services than traditional institutions. It does this by leveraging the internet, mobile devices, technology or cloud services.

Fintech originated as the term for the back-end systems of established financial institutions.

Today, it’s evolved to a broad range of financial services from PayPal to cryptocurrency. We use it to buy online, transfer money to our friends, deposit a check with our phones, and trade stocks on apps like Robinhood.

The global fintech market was valued at about $127.66 billion in 2018, and expected to grow at 24.8% to $309.98 billion through 2022. Digital payment providers are a main driver of growth as cash alternatives make paying for goods and services easier than ever.

Fintech vs Traditional Financing

What were things like before financial technology?

Throughout the years, traditional finance institutions have offered a variety of services like loans and stock trading all under one roof. You would rely on one or few institutions to manage all aspects of your finances.

Fintech, on the other hand, turns centralized traditional financial services into individual offerings.

Consumers use a dozen or so mobile apps and technology platforms to manage their personal and business finances. It’s a far cry from walking into a local branch and sitting down with a banker at every instance.

Fintech pushes beyond traditional financing to create faster, more secure, and modern financial solutions. This helps keep costs down for users, while making financial services more accessible to all.

Fintech and Ecommerce

For ecommerce, fintech is what makes transacting online possible and convenient. Digital-native brands use all types of solutions to disrupt traditional retail.

Fintech gives online shoppers more options than ever to pay online, no matter where they are and what device they’re using. It’s how you can buy a product that’s halfway around the world on your smartphone.

These solutions also provide online merchants smarter options to scale their business in a fast-paced and competitive landscape. Most fintech startups focus on SMBs that traditional institutions underserved.

Growing sellers don’t have to rely on traditional, slow, or costly financial and accounting processes to manage their operations. They have access to tools and resources tailored to their needs.

FinTech Solutions for Ecommerce

Let’s take a look at the top 10 fintech solutions in ecommerce.

Customer Financing Solutions

Not all consumers can buy the things they want right now. To give consumers access to more products, there’s solutions that split online purchases into manageable installments and allow consumers to pay later.

Popular providers are AfterPay, Affirm, and Klarna. These alternative payment methods are great options for luxury or lifestyle brands that have higher-cost items. Paying in installments allow consumers to budget for the high-end products they want.

Online Banking Companies

Conventional banks gear their bundled offerings towards serving larger organizations, where they’ll see greater profits.

For small businesses, traditional services that charge fees, impose minimum deposit requirements, and have lengthy approval processes can hold you back from growth.

There’s alternatives to brick-and-mortar banks like Rho Business Banking that make managing business finances easy and affordable. They offer services like:

- Online banking, no need to walk into a physical location

- Checking and savings accounts set up in minutes

- Corporate cards and/or prepaid cards

- Minimal to no fees

- High APY on business checking and savings accounts

- No minimum deposit requirements.

Global Currency Exchange Solutions

When selling globally, sellers have to deal with the overhead of international money transfers and currency exchange. These processes can cost online sellers in time and money. If you use a bank or traditional payment processors, fees can be as high as 3%.

For example, a $10,000 payout to a supplier in Japan could cost you additional $3,000 for the transfer AND more to cover the exchange rate. Costly and complicated processes like these can deter brands from scaling globally.

For transparent and affordable rates, online sellers can turn to a fintech company like OFX that offer better services for currency conversions:

- No hidden fees

- Secure an exchange rate for a fixed time period to control costs

- Set up a local bank account overseas to avoid exchange rates completely

Cash Advance Solutions

Most high-growth businesses deal with cash flow issues at some point or another. A gap in funds can lead to missed opportunities like holdouts to purchase inventory or marketing ads.

Securing cash when you need it isn’t always easy either.

Going to a traditional bank for a loan can involve credit checks, long approval processes, and origination fees. Venture capital isn’t always a great fit. If even an option, dipping into personal savings seems risky.

To deal with cash flow issues, there are fintech solutions for cash advances. These advances are short-term access to a lump sum of cash to use immediately.

Providers base the cash advance amount on your predicted monthly sales. You typically receive cash for amounts anywhere from 75% to 150% of your monthly online sales.

Fees for the advance are usually between 0.5% and 1% per week. As you sell, you’ll remit a fixed percentage (typically between 12% and 25%) of your sales until you pay back your advance.

Solutions like Payability focus on funding processes that work for online merchants.

- Base cash advance amounts on online sales and health account

- No credit checks

- Online applications with quick 24-hour approvals

- No hidden fees

- No origination fees

- No complicated paperwork

- Lower costs when you pay back early

Real-time Payout Solutions

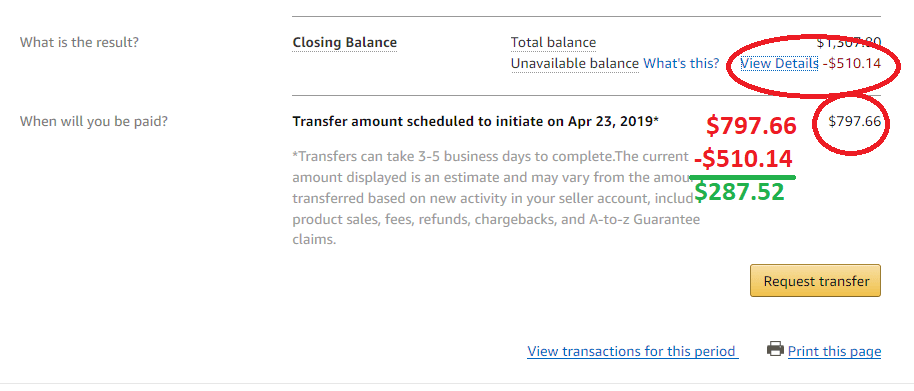

A reality of selling online is having your money tied up in long payout schedules. Platforms like Amazon and Walmart have delays between the day a customer places an order and the day funds from that order are sent to your bank account.

In some cases, it can take weeks to see your earned money! Sellers can wait even longer because of a platform’s own arbitrary processes.

For example, many sellers experience an “unavailable balance” on their Amazon account. This is the amount of money Amazon sets aside to cover any claims or chargebacks. Amazon can hold back all or part of your payment for weeks over several payouts.

Recently, eBay announced a transition from PayPal to eBay Managed Payments by 2021. Throughout the rollout process, there’s been mixed reviews of how it affects payout schedules. A notable difference is that PayPal Working Capital will no longer be an option, which many sellers relied on for access to their eBay funds.

Long payout schedules, unavailable balances, and changing payout processes demonstrate that sellers are at the mercy of the platforms they sell on. Are you confident you’ll receive your money when you need it? How does a platform rule or change affect your cash flow?

To receive their money faster, sellers can turn to real-time payout solutions. These providers accelerate your payouts based on your current sales and account health. You can receive yesterday’s sales as quickly as the next day. There’s no guesswork or angst in waiting for your next payout.

The cost of using real-time payouts comes at a flat fee of usually around 2% of sales (this can be lower for high volume businesses with $100,000+/month in sales). But, the fee usually is worth it when you consider the ability to access your own money faster.

Marketplace-Specific Financing Companies

Many ecommerce platforms offer their own working capital and loan solutions.

For example, there’s Amazon Lending and Shopify Capital. The benefits of these programs are:

- Access to funding or small business loans

- No interest, only repayment terms

- Offers show up in the platform itself once you’re eligible

While these can be a significant boost to your operations, it’s important to note that sellers can’t apply for them.

Instead, Amazon or Shopify identifies eligible sellers and chooses the capital amount. It’s up to you whether to accept it. There’s no way for you to predict when you’ll receive one, either.

Further, Amazon Lending and Shopify Capital only look at your sales on that specific platform to decide your funding amounts. If you sell across many marketplaces, then these funds might not be enough to make a difference.

In that case, it’s in your advantage to work with a cash advance or real-time payout solution. In most cases, you can use that alternative financing alongside Amazon Lending or Shopify Capital. You’ll also be able to apply whenever you need it and they’ll consider your sales across all your accounts to give you a better funding amount.

Accounting Software

A game-changer for growing merchants is access to accounting software, which automates your bookkeeping and paperwork for payroll, payments and more. It takes the pressure off trying to be an accounting expert, so you can focus on other areas of your business.

The top advantages of accounting software are:

- Affordable with monthly subscription rates starting at $9/month a user

- Access via the web

- Automate daily back office tasks to save time and ensure data quality

- Save money in the long run with better finance operations

- Direct integration with your marketplace or ecommerce platforms

If you’re not already using an accounting system, check out some of the top cloud-based accounting software for online merchants:

- Quickbooks Online – Starts at $25/month

- Xero – Starts at $9/month

- Freshbooks – Starts at $15/month

- Sage 50 – Starts at $50/month

- Zoho Books – Starts at $9/month

P2P Money Transfers

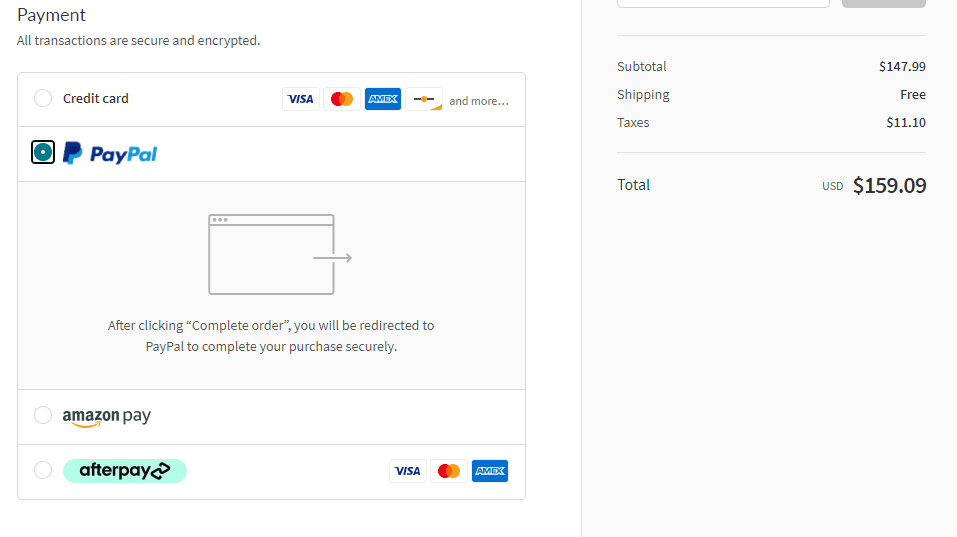

Consumers use peer-to-peer (P2P) payment systems daily. They’re digital wallets like Venmo and Paypal that allow you to easily send and receive money from your family and friends.

From Q1 2017 to Q1 2019, Venmo has grown their total payment volume from $6.8 billion to $21 billion.

In ecommerce, it’s always a matter of staying on top of consumer wants and needs. That’s why these P2P payment systems are making their way to check out pages.

PayPal and Venmo make online buying even more convenient. It can reduce card abandonment and boost sales.

Unlike credit cards, users don’t have to pull out a card to pay. It’s as simple as logging into your PayPal account to complete your purchase.

Spend management

Businesses rely on credit cards to manage their expenses. They’re also a great way to rack up reward points to go towards marketing ads, inventory, or other areas of your business.

The problem is that conventional credit cards usually aren’t enough for online merchants. There’s fees, low credit limits, and you don’t earn rewards for the type of routine purchases you make. Nothing’s worse than maxing out your credit card when you need to make purchases to keep your business running smoothly.

Luckily, sellers have options for credit cards tailored to ecommerce that maximize your benefits. There’s providers like Divvy, Brex, and the Payability Seller Card.

The main advantages of these cards are:

- Cash back on expenses

- High credit limits, based on your sales

- Fast approvals and virtual cards

- No interest, no fees

- Connect with accounting software like Quickbooks, Xero, NetSuite, etc.

- Connect with your marketplace sales

- Discounts and rewards on ecommerce-related software and services

Blockchain

The term blockchain keeps coming up more and more. What is it exactly?

In short, blockchain is a public “ledger.” It’s an electronic way to record any data transaction between two entities, such as a money transfer, a contract, or an order shipment. There’s no third-party involved in managing the transaction either, which keeps overhead costs down.

Each “block, or data record,” in a “chain” of transactions is timestamped, unchangeable, and viewable to anyone in the chain. This way the data is secure and trustworthy.

Watch this quick 2-min video to learn more about how blockchain works.

There’s lots of ways to use blockchains in ecommerce from loyalty programs to your supply chain.

It can help trace the journey of a single product from the manufacturer, to the distributor, and then to a seller’s warehouse. This level of visibility helps keep track of inventory and protects against fraud attempts.

The Future of Fintech in Ecommerce

Fintech has transformed traditional finance services across multiple industries, including ecommerce.

While traditional banks try to catch up, fintech startups are tailoring services to meet the unique needs of online sellers. From digital payment options to controlling cash flow with real-time payouts, fintech is helping online brands compete with bigger names and grow.

Here’s a recap of the top Fintech companies mentioned in this post:

- Payability

- AfterPay

- Affirm

- Klarna

- Rho Business Banking

- OFX

- Quickbooks Online

- Xero

- Freshbooks

- Sage 50

- Zoho Books

- Divvy

- Brex

What are some of your favorite fintech solutions you use in your online business?